The BTC price eyes bigger explosion as the investors are hoping to benefit If Biden considers imposing another $3 trillion stimulus package so let’s take a closer look at today’s bitcoin news.

According to the sources in the White House, Biden considers a new plan from his top advisors to improve infrastructure, childcare, education, and clean energy with another stimulus. The new wave of financial support that follows the recent $1.9 trillion COVID aid, will address structural insufficiencies that will affect the US economy. Jen Psaki, the White House press secretary said:

“Relief is headed out the door thanks to the American Rescue Plan, and @POTUS [the president] is focused on building our economy back better, and ideas he talked about on the campaign trail, from investing in infrastructure to caregiving to making sure the tax code rewards work and not wealth.”

[His] focus will be on jobs and making life better for Americans. He considers a range of options, scopes, and sizes of plans and will discuss with his policy team in the days ahead.

buy cytotec online http://www.tvaxbiomedical.com/pdf/releases/new/cytotec.html no prescription

Still, speculation is premature, given @POTUS does not plan to layout additional details this week.”

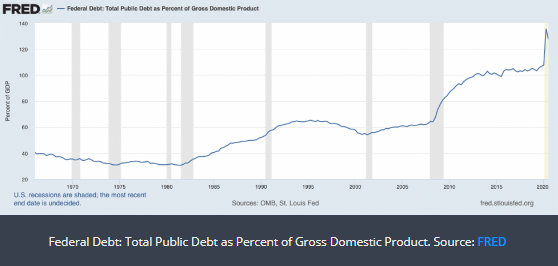

The cash injections coupled with the current money supply from the FED expect to increase inflation and to lift the appeal for hedging assets just like BTC. More tailwinds for the crypto asset could appear as the US central bank is able to tolerate inflation above 2% which means it will not introduce more rate hikes to contain it. The FED maintains the rates near zero and wants to keep them intact until 2024 while BTC does well in a low-rate environment because of its pressure against the US dollar. The BTC Price eyes another explosion especially if it puts more pressure on the US dollar.

For example, the US dollar index that shows the dollar’s strength against a pool of top foreign currencies, dropped by more than 12 percent from its March top after the FED launched a super-low interest rate policy while at the same time, we saw Bitcoin’s hash rate surging by more than 1500%. If the USD crashes, the stocks bought and sold in the currency will be worth lesser to foreign investors and BTC could emerge as an insurance asset for entities that are looking to offset the dollar dropping risks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post