The Bitcoin news today show that there has been a second stimulus check handout on the way and as a result of this, BTC paints a golden cross and could be eyeing the $10,500 level this week. The stimulus checks offered by the government of the United States are less than 1% of the $478 billion in cash – needed to buy up the entire year’s Bitcoin supply.

As we can see in the news now, only 1% of the two stimulus checks being sent to Americans in 2020 would be enough to raise the price of Bitcoin. This was according to some calculations that have been circulating on crypto Twitter this week, suggesting that as BTC paints a golden cross, the supply of new Bitcoins in 2020 could be bought up by less than 1% of the US stimulus money.

Treasury Secretary Steven Mnuchin launches stimulus debit card pic.twitter.com/MGe6UDTxyu

— Reuters (@Reuters) May 20, 2020

As the managing partner at the hedge fund Blockhead Capital Matthew Kaye noted on May 20, these numbers work by assuming an average BTC/USD price of $10,000 this year. In that manner, miners will unlock around 328,500 BTC which at $10,000 gives a total of $3.285 billion. This way, the total value of the two rounds of stimulus checks is $478 billion which is based on the latest comments on the handouts by the Treasury Secretary, Steven Mnuchin.

In order to keep the BTC price where it is, the latest cryptocurrency news must show a surge and an influx of only 0.68% of the stimulus money so that the coin can reach the $10,500 levels and buy up the new supply.

This equation is helped by the Bitcoin halving which occurred earlier this month – and which cut the number of new coins released per block by 50% and the inflation rate to 1.8%. Kaye admitted that he “does not expect” Americans to actually buy Bitcoin in such amounts with their checks. But if they do, we can see the picture of how BTC paints a golden cross extending – and the cryptocurrency going higher.

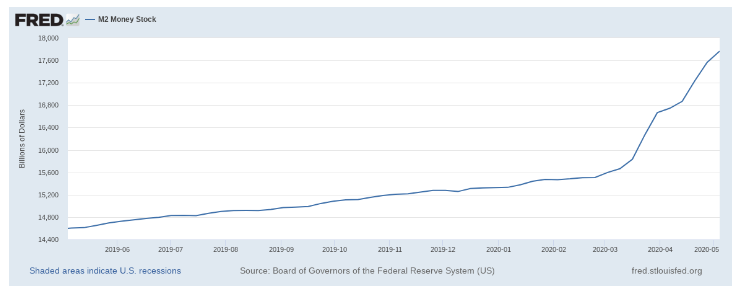

“I don’t expect 1% of recipients to buy bitcoin – I’m merely illustrating a point that increased M2 entering the real economy will increase asset prices,” Kaye summarized.

The analyst filbfilb also commented on this and released charts to subscribers on his Telegram trading channel, noting that the increased supply of BTC was now up 18% from October 19 last year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post