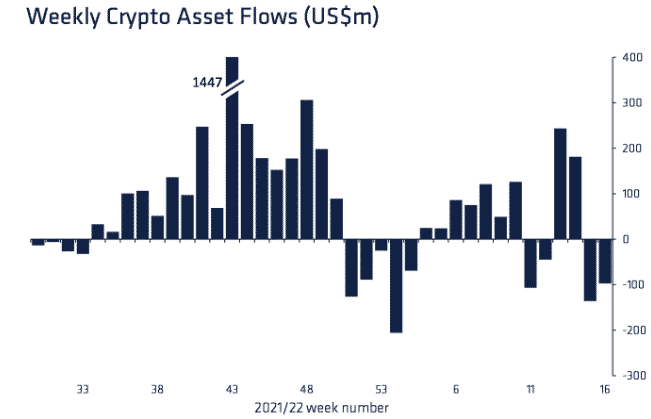

The BTC outflows from crypto funds reached $73 million after the recent FED policies and month to date, the outflows total $196 million so let’s have a look at today’s Bitcoin news.

The mix of profit-taking and the new investment products contributed to the net outflow of BTC and across all institutional investment products last week. The BTC outflows from crypto funds hit $73 million according to the reports from Coinshares. The company published weekly reports on institutional allocations in crypto products like the ones offered by Grayscale, 21Shares, and CoinShares XBT. The products provide more exposure to single coins like BTC, ETH, And other assets.

Two weeks ago, most of the outflows were from the US but last week’s outflows about 88% of them, were from Europe. This could be a delayed reaction to the hawkish FOMC statement according to CoinShares strategist James Butterfill. The FED Open Market committee adopted some new rules and banned senior Federal Reserve officials from purchasing crypto, foreign currencies, and individual stocks. The new FOMC rules will take effect on May 1 when the clock starts for the officials to dispose of the banned holdings in a year. The rules will require all 12 reserve bank presidents to publish their financial disclosures.

Buterrfill also noted there are few bearish weeks of money flowing into the short BTC products and the flow reversed as the investors unwound $1.8 million from the last week. The short of an asset means that you bet against it and try to make money while it loses value. The BTC outflows across investments products accounted for $73 million from last week which brought the total month-to-date BTC outflows to $196 million. Ethereum and other altcoins followed where BTC Went and the ETH outflows totaled $27 million while Solana and Cardano were down by $700,000 for the week.

$34.3 billion assets under management were in BTC by the end of last week and $13.3 billion were in Ethereum while another $3.8 billion were in multi-asset products. These products give investors mroe exposure to coins and still remain a firm stalwart and saw inflows of $5.3 million a week ago.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post