The BTC option data suggests bearish sentiment among investors as the asset ranges between $29,000 and $30,000 price levels so let’s have a closer look at today’s latest Bitcoin news.

The BTC options data suggests there is a growing bearish sentiment among investors after BTC dropped to almost $24,000 in the past week and brought many systemic risks within the ecosystem like rising inflation fears. The asset slid for seven weeks as of Friday which is a new record. The asset’s price movements were highly correlated to the US markets in the past few months with some poor earnings reports and comments from the FED that showed an impact on its price.

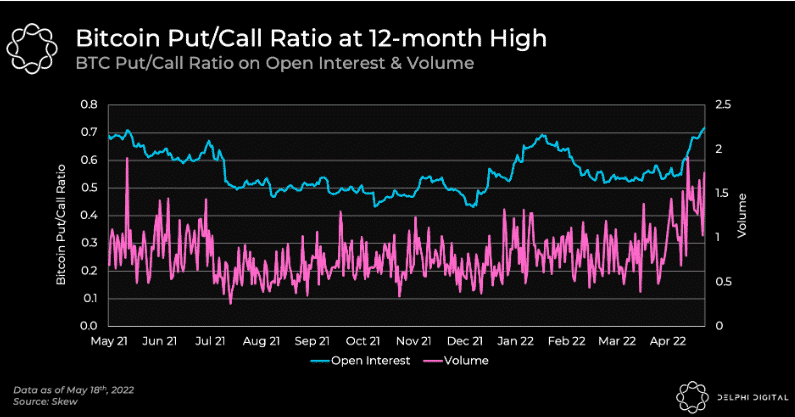

The put/call ratios for BTC open interest hit a 12-month high of 0.72 as the research from Delphi shows, adding the data indicated a bearish sentiment among investors, similar to the ratio levels seen back in May. Delphi analytics explained:

“The put/call ratio measures the amount of put buying relative to calls. A high put/call ratio indicates that investors are speculating whether bitcoin will continue to sell off, or it could mean investors are hedging their portfolios against a downward move. Last April, the put/call ratio traded as high as 0.96 before Bitcoin’s price dropped over 50% in May 2021.”

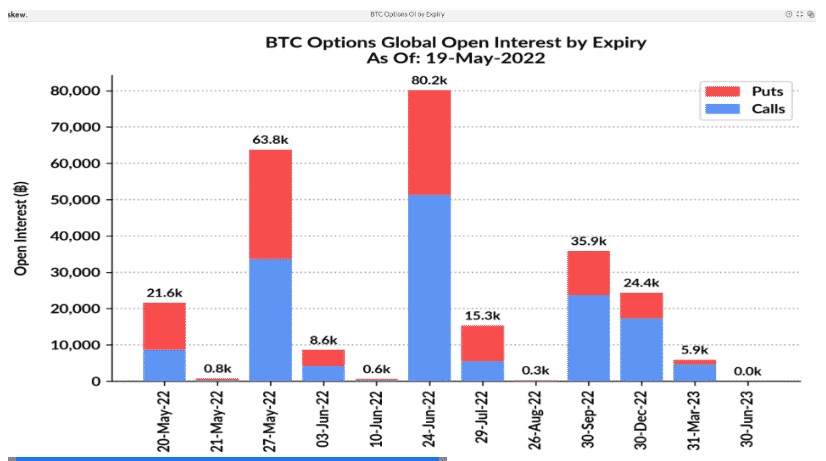

The put options are a contract that gives the option buyer the right but not the obligation to sell an amount of the underlying asset at a given price. The call options allow buyers to purchase the asset at a predetermined price in the future. There is over 63,000 BTC worth of open interest on options which will expire on May 27. The surge in the put/call ratio surpassed the previous 2022 highs and is up by 38% from the one-year lows of 0.44 in December. The exchange Deribit leads options volumes with $7 billion in open interest and these levels are recovery from last month which saw a $2 billion drop in the open interest over two days from April 28 to April 30.

As reported earlier, A day ago was quite the negative trading day on Wall Street with bigger losses coming from S&P 500, the Dow Jones Industrial Average, and NASDAQ. All of these indexes dropped by 5% in oen day with the most having lost substantially since the first months of the COVID pandemic.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post