BTC nears crucial levels not seen since 2020 near the $20K level as prominent crypto companies see possible insolvencies so let’s read more today in our latest Bitcoin news.

BTC nears crucial levels near the $20,000 as it extended a 12-week slide amid the weak macroeconomic sentiment and the contagion risk within the market. Lender Celsius paused all withdrawals this week citing extreme marekt conditions and leading to questions about the company’s liquidity. The prominent crypto fund Three Arrows faced the least $400 million in liquidations and lowered its collateral levels by selling key positions from this morning.

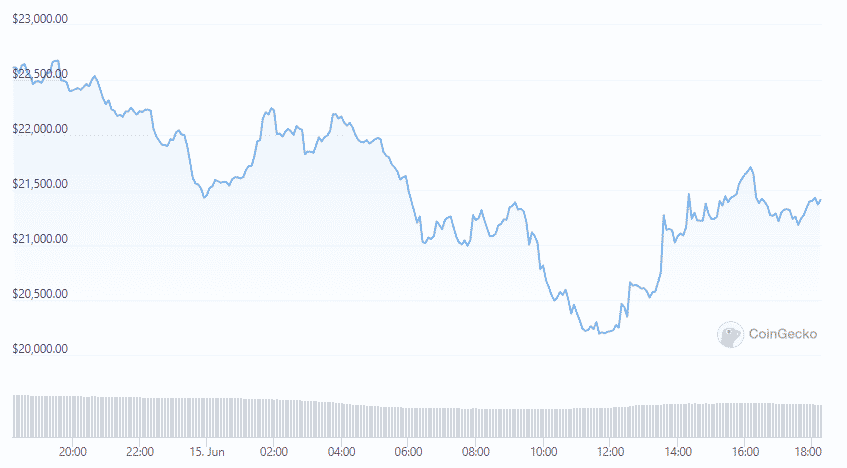

BTC fell to above the $22,000 level in the US hours and the decline gained pace during Wednesday morning with the crypto dropping under $21,000 and dropped for the eighth consecutive day and lost 30% over the past week. The asset traded reached a low of $20,169 this morning which is a level that was seen in mid-2020 and marked BTC highs in late 2017. FxPro senior analyst Alex Kuptisikevich added:

“Concerns around a sharp tightening of monetary policy are weighing on financial markets and are trickling down into cryptocurrencies through their influence on large institutional investors. It is not surprising that bitcoin and ether are dragging the entire cryptocurrency market down in such an environment.

buy stromectol online https://clinicaorthodontics.com/wp-content/themes/twentynineteen/inc/new/stromectol.html no prescription

“

The US consumer price index report from Mau showed inflation in the world’s biggest economy which hit 8.6% year-on-year basis or 0.3 percentage points more than the expected 8.3%. The data sent global markets downward earlier this week with investors pricing further rates increases and the FED trying to bring prices under control. The fall in equity prices came as traders expected companies to report low revenues and consumer spending so the observers expected the central bank’s actions to impact BTC prices. Executive director at ARK36 Mikkel Morch added:

“Over the past couple of years, cryptocurrencies have become a global macro asset. So it is to be expected that they will react negatively now when investors realize that central banks haven’t reacted nearly as aggressively as they will need to in order to get inflation under control.”

He continued:

“The global economic environment is becoming extremely tough to navigate for investors involved in all kinds of markets, so it is no surprise that bitcoin is also facing increased downward pressure.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post