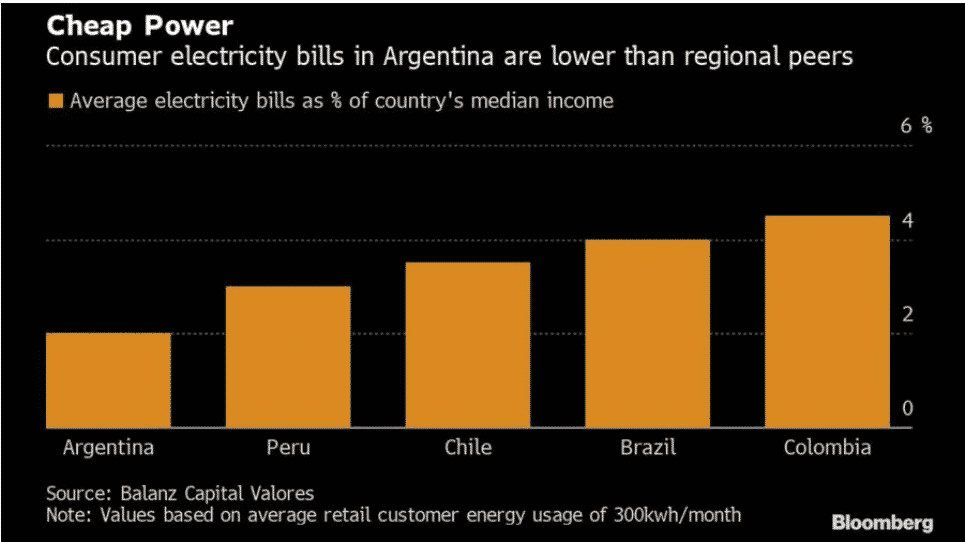

BTC mining surges in Argentina as per the latest data, because of the subsidized and cheap energy in the country with miners working from their homes and their monthly electricity bills reaching 2% of their average monthly income as we can see more in our latest bitcoin news today.

Countries with low utility rates are perfect for crypto miners and the resurgence of capital controls is now boosting the profits for the miners in Argentina as the BTC mining surges in the country. The news was initially reported by Bloomberg and republished later by the Buenos Aires Times. Experts like the crypto-miner in Argentina Nicolas Bourbon said that this is a huge chance to take advantage of the new policies that are implemented by the local government.

“Even after Bitcoin’s price correction, the cost of electricity for anyone mining from their house is still a fraction of the total revenue generated. Miners know the subsidies are ridiculous. They simply take advantage of it.”

Compared to Chile, Brazil, and Colombia, the consumer electricity bills are about 3% of the average monthly income in Argentina which makes it the cheapest country in the continent right after Venezuela. BitFarm LTD which is a Canadian mining company signed a new power purchase agreement with a private Argentinian power producer that enables the company to extract crypto in Patagonia in 2022 with the use of 55,000 machines. The contract will last for 8 years and has a cost of 0.022 per kilowatt/hour. The president of Bitfarms Geoffrey Morphy noted in an interview:

“We were looking for places that have overbuilt their electrical generation systems. Economic activity in Argentina is down, and power is not being fully utilised. So it was a win-win situation.”

The cheap electricity in Argentina was tagged as a policy that aimed to win votes for the next legislative elections by experts and caused tensions between other political parties with the miners seeing this as a good chance to reap profits and to survive the expanding hyperinflation. Argentina’s economic downturn propelled crypto usage and the current inflation rate is about 50% per year so citizens can legally concert about $200 per month and all of Argentina can embrace crypto assets as an inflation hedge.

Crypto accounts on Coinbase and binance soared in the country while the Argentinian Peso dropped in value over time. It should not come as a surprise that the miners are choosing a country to take advantage of the cheap electricity:

“The crypto that miners generate is typically sold at the parallel exchange rate, but the energy is paid for at a subsidised rate. At the moment, revenues are very high.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post