The BTC mining difficulty records new ATH after a 21.5% increase which is the biggest in three years as we can see in our latest Bitcoin news today.

It is now harder to mine BTC than ever as the BTC mining difficulty records a new high soaring by more than 21.5%. This is the biggest increase since October 2017. The new ATH of 25 trillion represents a 21.5% increase since the last readjustment when the difficulty dropped by 12.6% recording the BTC networks biggest downward correction since the year started.

#Bitcoin mining difficulty has increased by 21.5% today.

It is the largest positive difficulty adjustment in almost 7 years.

Chart: https://t.co/VSa6oGAPZF pic.twitter.com/ynFPBBDBKh

— glassnode (@glassnode) May 13, 2021

The difficulty is a relative measure of the amount of the computational resources that are required to produce new coins with the value increasing or decreasing after every 2016 block or every 14 days depending on how quickly the previous 2016 block was found. The average block production interval is intended to be 10 minutes since the last readjustment which was substantially faster somewhere about 8.25 minutes which means that there’s growing competition among miners as more hash rate or the combined computational power used to mine and process transactions that are being sent to the network.

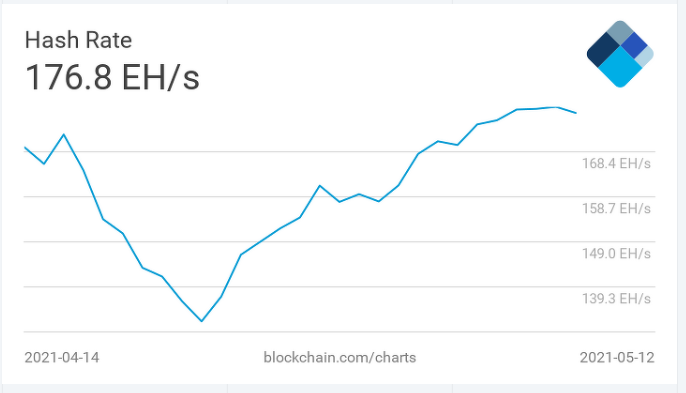

Earlier this week, the BTC network’s hash rate hitting a new ATH above 178 TH/s before dipping slightly in the past few days coupling with the fierce competition and the latest drop in the BTC price below $50,000 with the increase in mining difficulty is likely to affect miners’ revenues. There’s good news for the average users with the faster block production interval which has helped to clear out the memepool which means that your stuck transactions will not have to wait long before being confirmed.

As reported recently, Over the past 24 hours, we saw $4 billion of BTC and other coins got liquidated after Tesla’s decision to stop BTC payments. Today is a bloody day in the crypto market with the current downturn being propelled by Tesla’s recent announcement which shows that the company won’t accept BTC as payment for its electric vehicles. The car manufacturer announced that it will no longer accept BTC for its products.

Moreover, around $4 billion worth of long and short positions were liquidated at the same time as per the data by ByBt. BTC markets account for the majority of the liquidations and stand at over $2 billion at press time after ETH and Filecoin. Almost 90% of the liquidations were long positions where ByBt and Huobi occupied the first two spots in terms of volume after Okex and Binance.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post