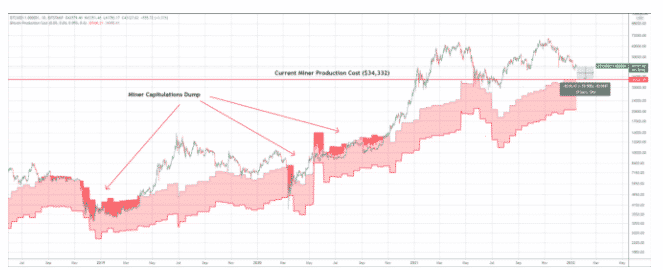

The BTC miners can take 20% BTC price hits as the production for the miners sits around $34,000 and together with the fees, the miners don’t have to worry about other support challenges as we can see more today in our latest Bitcoin news today.

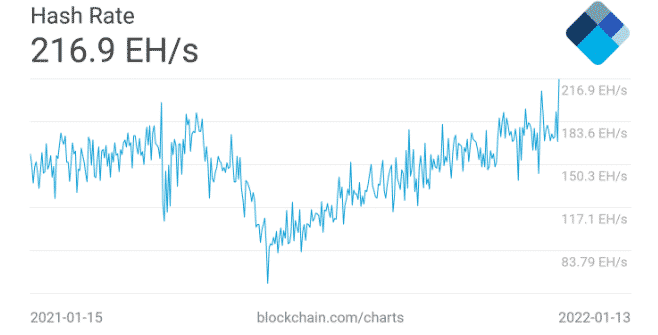

The bitcoin mining business is much bigger than ever at current price levels and the new data shows just how unlikely a mass miner sell-off is. As noted by the Twitter account @Venturefounder, at $42,000 the BTC/USD tradign pair is about 20% above miners’ cost price. Despite falling a full $27,000 below the all-time high, BTC is more enticing than ever for miners and the hash rate as an estimate of the total processing power dedicated to mining, reached a new high this week.

The BTC miners can take a 20% BTC price hits before capitulating and those concerned that the fresh BTC price dip could pressure the miners into selling while receiving a fresh assurance via data covering how much the BTC/USD could trade at for them to break even. Referencing the BTC production cost indicator from Charle Edwards, the CEO of Capriole, the Twitter user revealed that the breakeven point now stands at $34,000:

“The worst dumps Bitcoin ever had been due to miners capitulation (December 2018, March 2020), when BTC fell below production costs, it is at risk for miners capitulation. BTC was at risk for miner capitulation at $30k in May. The current production cost is $34k, 20% below current price.”

There’s no reason for miners to sell thanks to the profitability as well as a future perspective of the operations. In a post about the indicator from 2019, Edwards noted that transaction fees awarded to miners give them an additional cushion against the spot price incursions which is below the production cost:

“Historically, the electrical cost to produce a Bitcoin has represented a price floor in the Bitcoin market price.”

The miners are indeed voting with their wallets as BTC consolidates below the $50,000 price range. Rather than selling, the miners are accumulating BTC en masse, especially over the past few months. This speaks both about a balance sheet that is healthy and resolves the future fears of an economic crash on the horizon which are not currently weighing in on the mining sector. Going forward, the worst-case scenario estimates that the BTC price floor will be no lower than $30,000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post