A BTC miner mayhem struck the users as the on-chain fees dropped by 90% in two months and at the time of writing, the number one cryptocurrency lost two major support zones at $35,000 and $32,000 as we can see more in our latest Bitcoin news.

Bitcoin was struck by the bears in a third consecutive week and lost two critical support zones at $35,000 and $32,000 so the market cap trades at $31,987 with a 10.5% correction on the daily charts. The general sentiment on the market seems quit3e bearish as BTC failed to gain a strong foothold on the current levels. As reports by Arcane Research show, there’s a correction following a week with low exchange activity a dropped in on the on-chain activity and the futures premiums have almost gone.

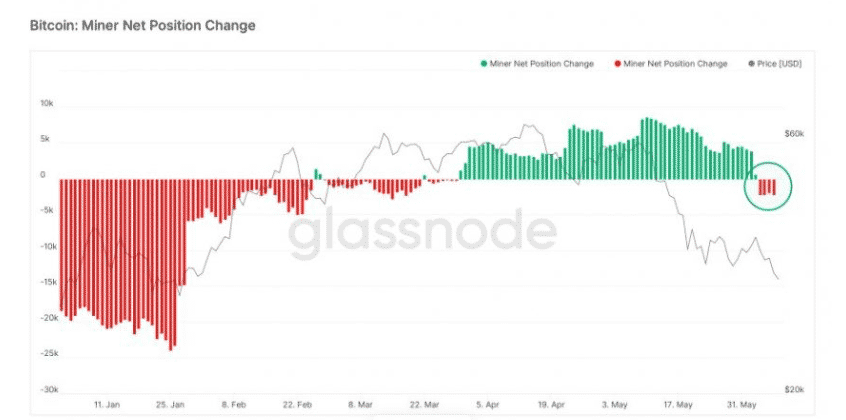

The research shows that the on-chain activity has descended by about 69% since the start of May and April and the BTC network fees declined by about 93% as seen in the charts. The average daily transactions on Bitcoin’s network went from $62 to $4.38 at the start of June and at the same time, the 7-day average mempool transactions reached their lowest level since April 2020 as the research shows. This coincided with the mining sector increasing their sales and China placed new limitations on the sector for certain mining activities at a grand scale with some miners being forced to relocate their operations. It seems only logical that they sold a part of their holdings to obtain liquidity for expenses.

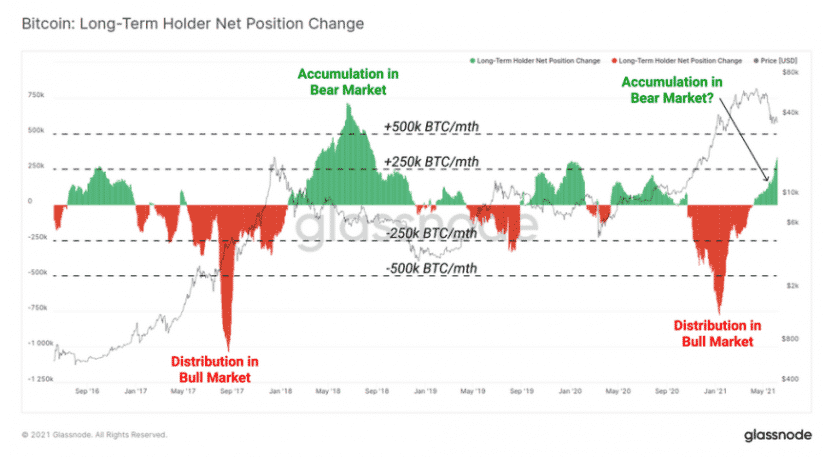

The CIO at Moskovski Capital Lex Moskovski said that about 8,545 BTC left miners’ wallets in the last 4 days and the increase in selling pressure contributed to the crash. The BTC miner mayhem was not that bad for some as they tried to accumulate. The data from Glassnode suggests that the total Bitcoin supply held by long-term holders was on a rise after reaching a peak in March. The rise in the metrics went parabolic as of May when BTC’s price took a hit. The investors bought more than all of the bitcoin supply sold by short-term investors and Analyst William Clemente believes that the number will be around 217,194 BTC:

“Selling from short-term holders had been offsetting buying from long-term, but now long-term holders buying is offsetting short-term hodlers selling.”

Further data recorded by Glassnode shows that 744,000 BTC were withdrawn from exchange platforms into cold wallets since 2020 when BTC was as low as $3000. During May and June, up to 160.700 of the BTC supply returned to the market and this increase represents 22% of the overall supply that gone cold. Analyst Checkmate thinks that this sell-off is a change in conviction by a portion of the market. The fact that the long-term holders returned to accumulate a Bitcoin bullish sign, the analysts think that there could be similarities between this behavior and the accumulation period in 2018.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post