BTC made double digit gains over the week despite the bearish action over the past 24 hours and both BTC and ETH posted solid gains over the past week so let’s read further in our latest Bitcoin news today.

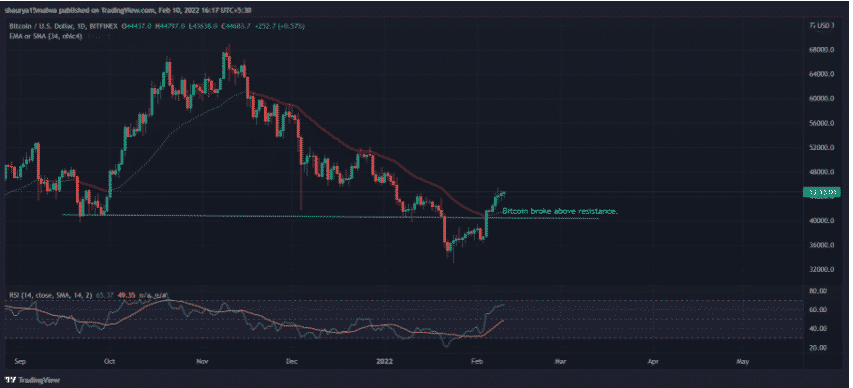

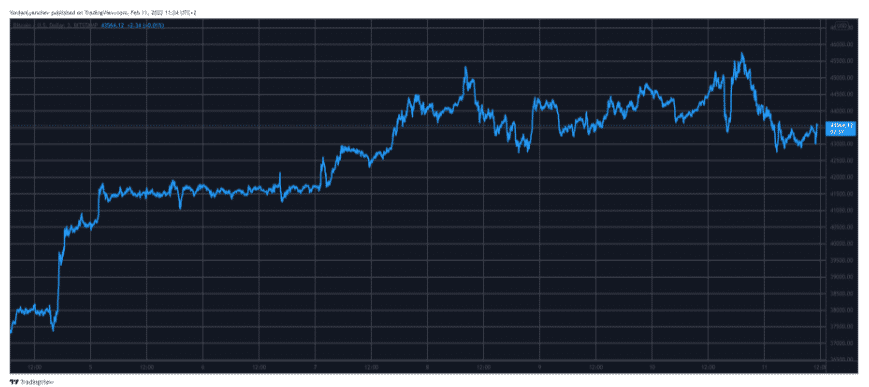

The crypto market seems to have shrugged off the weeks of lackluster performance as the price of BTC increased 14.5% over the past week and it is the current value of over $43,000 according to coinmarketcap. Bitcoin slid by about 3% over the day after hitting $45,000 but it is now well above this year’s bottom of $33,500 that was seen at the end of January. This could not be enough for some investors with some analysts saying that the asset manager Blockforce Capital indicates the average price investors bought BTC at over the last five months being set at $47,000 and as per Blockforce Capital’s Brett Munster it means that on average anyone that bought during the same period lost money and could not be inclined to buy more until they break even.

Blockforce saw $47,000 as a “key threshold” for the price of BTC which is also the 200-day moving average for the number one cryptocurrency which is an indicator for determining which direction markets are trending in the crypto and traditional markets, as Munster noted:

“This threshold could provide resistance as those recent buyers may look to recoup their investment and sell off. However, should we break through and stay above this $47,000 threshold, it could provide those recent investors with the confidence to re-enter the market and start buying again.”

Bitcoin is down by 37% from the November high above $69,000 and while Blockforce reckoned that it is still far too early declare with certainty that $33,000 was the bottom and the company even said that there’s now much asymmetry to the upside than it is to the downside:

“That doesn’t mean Bitcoin couldn’t fall back down again, but the data seems to suggest that the upside potential now outweighs the downside.”

In the meantime, Ethereum is the second biggest crypto after BTC in terms of market cap and it is down by 5% over the day and now trades hands at just under $3100 according to CoinMarketCap and with that said, the coin gained over 9% in value int he past week. Ethereum is facing an increase in competition from the growing list of blockchains including Cardano, Avalanche, Polkadot, and more as some industry figures are quite bullish on the coin’s long-term future. The CEO of Canadian digital asset exchange NDAX Bilal Hammoud is one of them and predicted that the price of ETH will hit $10,000 by the end of 2022 as the coin’s value increases because of scarcity and the imminent transition to proof of stake. Hammoud said:

“Ethereum’s latest upgrade turned into a deflationary asset. Proof-of-stake will further lock up ETH for staking rewards, which in theory should influence the price to go up as supply decreases, while demand increases.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post