The BTC lender Celsius Is joining BlockFi on the list of companies getting scrutiny from state securities regulators as we are reading more today in our crypto news.

BlockFi is a New Jersey-based crypto lending platform and it faced a lot of scrutiny from the state securities regulators all summer and Coinbase also was warned by the US SEC that it will be sued if it launches its high-yield Lend program. Now the BTC lender Celsius is catching up on the regulator’s target list. The New Jersey Bureau of Securities filed a cease and desist order against the company to stop offering high-interest accounts to all New Jersey customers by the end of October. Today, the Texas State Securities Board also ordered the company to appear for an administrative hearing and even threatened to issue its own cease and desist orders against the company to stop serving the clients in the state. The order also declares that fines and restitutions are one of possible remedies.

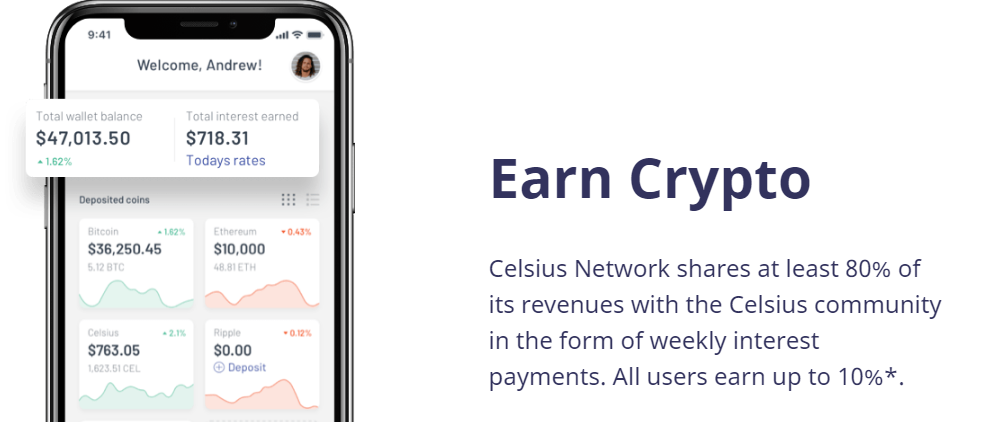

The issues are Celsius’s crypto interest accounts. Clients are able to sign up for the platform and deposit cryptos they own with Celsius which loans them out. In return, the clients receive interest rates higher than the rates from traditional bank savings accounts. The network advertises returns of up to 17% but their rates are updated every week and vary from asset to asset. Right now, stablecoins like Tether and USDC fetch 8.88% while Ethereum and BTC got interested worth about 5-6% per year.

Texas and New Jersey noted that the Celsius API partner program is reaching for these accounts because the API partners can then offer and sell the unregistered Celsius Earn Interest-Bearing Account to their clients. None of this according to the regulators is sanctioned by the state because Celsius has not registered with the agencies nor with the SEC to start selling securities that are tradeable investment products. Most lawyers that specialize in digital assets see this yield product as securities because they function as an unsecured bond where the borrower agrees to pay someone back without having to provide collateral.

The same issue was with BlockFi which recieved a cease and desist order from the New Jersey attorney general’s office which was followed by a cease and desist order from Texas, Kentucky, and Vermont. As a result, BlockFi’s market coverage is getting smaller and it no longer offers its BlockFi Interest Accounts to the Texas residents and has to stop serving in New Jersey as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post