BTC indicators that guess bottom levels predicted a $15K price floor as one analyst warned so let’s read more today in our latest Bitcoin news.

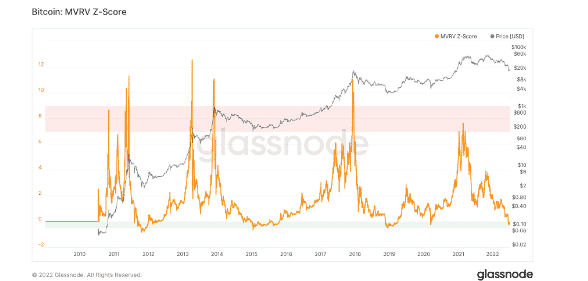

The MVRV-Z score is a tested bottom indicator that is not back at the base yet but the BTC indicators that guess the bottom, are eyeing the $15K price floor. BTC needs to go lower before entering a macro bottom as one of the market’s most accurate indicators shows. The data from other sources like on-chain analytics company Glassnode shows that the indicators are signaling a price reversal. Amid the debate about whether or when the pair will go beyond the macro low of $17,600, the new figures suggest that the market has further to fall.

Some very important #BTC levels:

16k – Average Deviation from MA50 (-25%)

14k – 2019 Echo Bubble Top

12.2k – Celsius Liquidation

10.7k – Key Horizontal Level https://t.co/hEcnj8wsak pic.twitter.com/1Xke0F7WSe

— CryptoBullet (@CryptoBullet1) July 2, 2022

The co-founder of the trading suit Decentrader, said the indicator is now in the classic green zone but not yet at the point which is accompanied by price bottoms in the past. The indicator measures how high or low the BTC spot price is relative to what is referred to as a fair value. The indicator uses the market cap and realized price data alogn with the standard deviation o create what was one of the most efficient BTC top and bottom prediction tools. MVRV-Z caught each macro top and bottom of the pair in its history and it did it with such accuracy as the data resources show. The metric went below the green zone a few times and the last time it was seen was March 2020 but the downside pressure would deliver a repeat performance.

The $15,600 level will tie in with various existing predictions of where BTC is due to bottom. In the meantime, the popular account CryptoBullet included this area as one of the biggest support zones to watch out for. If $16K is confirmed, it will mark the average deviation from BTC’s 50-month moving average and the RSI is already at the lowest ever level as another indication of the oversold nature of the market is below the previous halving cycle’s peak of $20,000.

Bitcoin’s weekend continues to be calm compared to the previous days as the asset still sits around the $19K level and other altcoins are in a similar position with almost no movements from the larger cap ones. Last week was not well for the main cryptocurrency which spiked to $22K at one point but then as it happened a few times in the past, it failed to continue its upward movement and reversed its trajectory quite fast.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post