BTC hovers below $50K as the crypto community awaits for FED chairman Jerome Powell to address the rising bond yields. The recovery of the number one cryptocurrency stalled as caution sets before the FED chairman comments so let’s see more in our latest BTC news today.

The cryptocurrency is now nursing losses below $50K and bounced from $43,000 to $52,500 in the past four days. The Q&A between Wall Street Journal and Jerome Powell is under the waking eye of the investors as it could influence a riskier sentiment in the financial markets and eventually set the tone for another big move in BTC. What Powell says about bond yields could be of interest as trader and analyst Alex Kruger explained. According to the ING analysts:

“Comments that [Powell] is monitoring events in the Treasury market might be enough to calm things down, encourage a return to a softer dollar.”

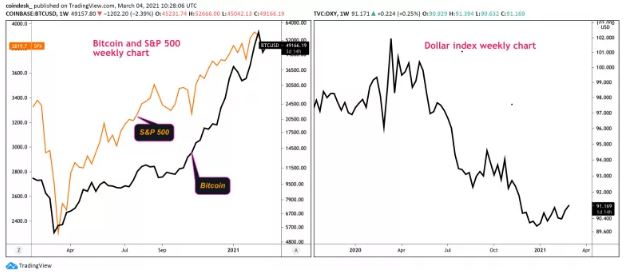

This would bode well for BTC and stocks as both assets mostly moved in the opposite direction to the dollar index in the past 12 months. However, the rally in yields will speed up and will lead to a stronger dollar and weaker bitcoin if Powell downplays the concerns in the rising bond yields as the ING analysts noted:

“No such concern [from Powell] would suggest the Fed is happy for Treasury yields to ‘find the right level’ – as our bond strategy colleagues say – potentially triggering another spike in yields and more dollar short-covering.”

At press time, BTC hovers below $49,010 which marks a 5% drop in the past 24 hours. The 10year US yield I seen at 1.46% and the dollar index is hovering above 91 which represents a 0.2% gain in the day. The 10-year yield surged to a 12month high last week with the traders pricing in prospects of the stimulus by the FED. Both stocks and BTC faced selling pressure with the latter dropping 20% which marked the biggest single-day drop in 12 months. Both asset types benefited from the FED massive stimulus delivered since March 2020.

According to the City analysis, the markets are having an 80% chance of a 25-basis point Fed rate increase to 0.25% by 2022 and the first interest rate until weeks ago was expected to initially happen in 2024. The dollar index already broke out of the falling wedge pattern on the charts which indicated the end of a year bearish trend and a reversal higher. The Rising dollar is one of the biggest headwinds for BTC’s trend as Kruger noted.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post