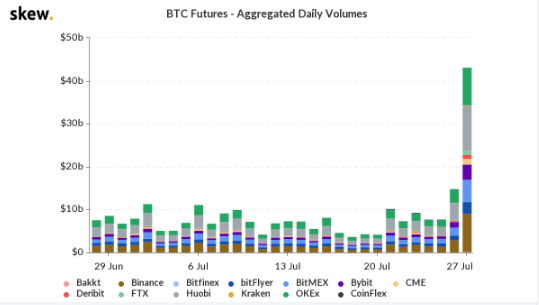

The BTC futures volume skyrockets to $40 billion, following the latest bitcoin price movement with an aggregate open interest and trading volume reaching the highest numbers since March as we are reading further in the latest Bitcoin news today.

As the BTC price rises, the futures market is booming and the aggregate open interest and trading volume reached the highest level since the March Black Thursday crash. The BTC futures volume skyrockets but regulated markets are included here as well as Bakkt registered record volumes back on Monday. Bitcoin’s recent price surge was followed by an explosive volume in derivatives markets and the data from Skew analytics, the aggregate open interest on Bitcoin futures markets reaching $5 billion which is the most since the Bitcoin price crashed during the Black Thursday mid-March crash.

Since the open interest reflects the total value of the active derivatives contracts on the market, high open interest denotes healthy investment activity especially when the asset is increasing in value. What’s even more, the daily trading volume of BTC futures on Monday which is the same time the price increased by 12% to $11,300, hit the second-highest figure ever as the aggregate futures volume across the BTC regulated and unregulated futures markets reached $40 billion yesterday.

The futures market hit $50 billion during the Black Thursday on March 12 when the bitcoin price dumped alongside the macro market selloff which left the equalities and the precious metals in the red. The daily volume on BTC futures markets didn’t surpass more than $15 billion in the past 30 days. This near-record volume reflects the huge buying pressure which sent Bitcoin above $10,000. The price rally comes at a time when silver and gold are surging and one explanation for the rise is that the investors are looking an alternative asset to hedge against inflation as central banks continue to ramp up monetary responses to economic uncertainty and the bulk of the volume, as usual, comes from unregulated BTC exchanges.

The CME’s futures market experienced its second-best data with a $1.3 billion in volume as Bakkt which launched at the end of the year, had its best performance day with $122 million in BTC futures volume. Also, US Banks can now provide custody for digital assets and the growing volume in institutional-grade markets could be a huge sign that the high-net-worth investors will turn to BTC now more than ever.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post