The BTC Fear and Greed index falls to its lowest levels since the COVID crash with the fear dominating the BTC market for more than a month so let’s read more today in our latest Bitcoin news today.

Amid the ongoing crash on the crypto markets, the popular BTC Fear and Greed index crashed into the extreme fear territory and the metric is at its lowest position after the COVID crash. The markets took a massive turn for the worse and at that time, BTC was riding high to $50,000 with the community wondering if it will be able to breach the level and head for a new high.

Lowest reading on dormancy flow EVER.

Either this signal is broken and this time is different or this is one of the best accumulation opportunities for BTC ever. pic.twitter.com/hDThFVllHj

— Will Clemente (@WClementeIII) June 14, 2022

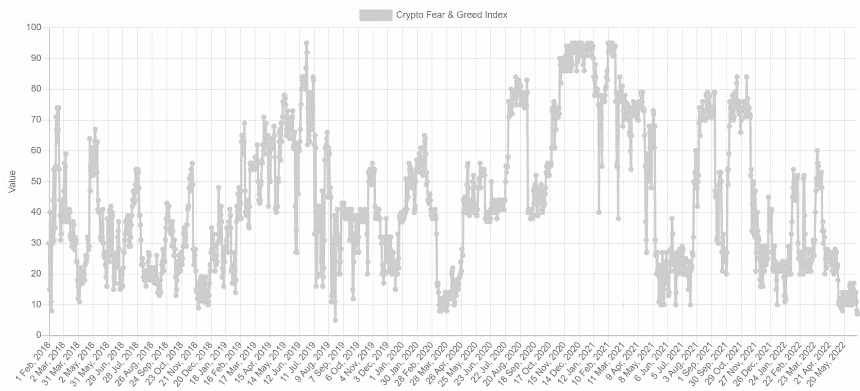

However, this was not the case and BTC entered a long negative streak. The crypto closed the next nine weekly candles in the red losing $20,000 in value. It remained near $30,000 for a while but then crashed again on Friday. The weekend brought more pain and as a result, BTC dumped to over $20,000 which became its lowest price point since December 2020. The bearish trend resulted in a massive shift in the investors’ beliefs and the overview of the marekt which is best presented by the BTC Fear and Greed Index shows the overall sentiment by gauging different sorts of data like surveys, volatility, and social media comments.

It also shows the end results from 0 to 100 while since May, the index was inside the extreme fear territory and the past few days saw another decline in the metric showing 7- the lowest position since the COVID pandemic. Whether this volatility hits the market, analysts rushed to provide predictions of what will happen next. By basing the forecast on a double top that BTC formed, the trader Peter Brandt said that BTC is poised to drop further which indicates a short-term bottom of $13,000.

Another analyst Will Clemente sees the crash as a buying opportunity since the dormancy flow metric hit its lowest points. It shows an average number of days that each spent and remained dormant before moving. As the charts show, once the metric goes down, BTC tends to bounce off.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post