The BTC exchange reserves drop as BitMEX drama continues and analysts pinpoint the trend to the shortage of sellers so let’s read more in the upcoming Bitcoin news.

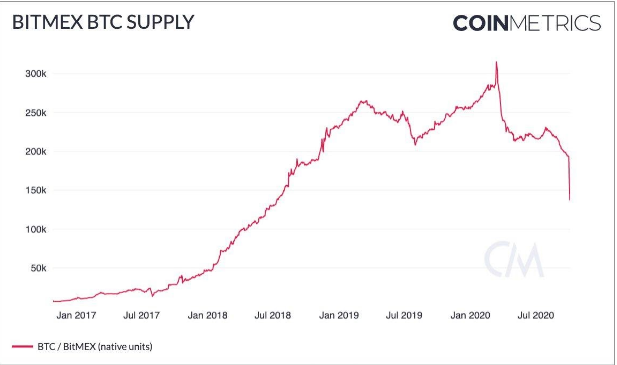

BTC exchange reserves are plummeting still as analysts pinpoint the trend to a shortage of sellers as after the March crash the reserves on exchanges fell from 2,950,000 BTC to 2,700,000 BTC. In about seven months, about 250,000 BTC fall in exchange reserve signifies the $2.85 billion decline but behind the steep trend could be two major factors like the drop in sellers and lower trust for exchanges. Analysts mainly attribute the sustained drop on exchange reserves to an overall shortage of the sellers in the market.

The retail sellers are refrain from selling BTC at the current price as the institutions acquire more Bitcoin. As the BTC Exchange reserves drop, the selling pressure and the increase in buyer demand is an optimistic trend for the number one cryptocurrency. A trader known as “Oddgems” said the data shows Bitcoin is moving from exchanges to wallets. If so, it shows that investors are moving their funds in order to hold them for a longer period:

“More and more #Bitcoin getting out from exchanges and most probably being transferred to non-custodial wallets. This suggests slightly lower liquidity and lower selling pressure going forward.”

Michael van de Poppe, the popular trader at the Amsterdam Stock Exchange supported the stance. He outlined that BTC outflows from exchanges are growing as the cash reserves from institutions are getting into BTC: He noted:

“To be honest, more and more $BTC going from exchanges towards cold wallet storage. Big listed companies allocating cash reserves to $BTC. Is incredibly bullish.”

The confluence of stagnant retail outflows from BTC and the demand from institutions are supporting the general sentiment around Bitcoin. Dan Tapiero, the co-founder of 10T Holdings also said that the shortages of BTC can happen because of the surging institutional interest. According to Glassnode, a huge portion of the BTC supply is stored in the accumulation addresses which represent the users that never move their bitcoins from their wallets and are likely storing Bitcoin in the long-term. When HODLing gets high, it indicates the start of the accumulation phase as Glassnode said:

“Bitcoin accumulation has been on a constant upwards trend for months. 2.6M $BTC (14% of supply) are currently held in accumulation addresses. Accumulation addresses are defined as addresses that have at least 2 incoming txs and have never spent BTC.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post