A new Bitcoin price pullback is awaited by many but despite all of it, the BTC exchange inflows spiked lately. According to one analyst named CryptoQuant, there would be a “small” retracement below $9,000.

The Bitcoin news also show that the price of the dominant coin is edging closer to a $9,000 support level and may lead to a major sell-off by exchange users. According to data from on-chain analytics resource, inflows of Bitcoin (BTC) to exchanges spiked on July 15.

When traders return their Bitcoin to exchanges from a private BTC wallet, it suggests that they have a desire to either trade or sell at short notice. In an opposite scenario, we can see that this is also true. As we reported in our cryptocurrency news before, the BTC exchange inflows and balances witnessed a major downtrend which in May hit its lowest since late 2018, when BTC/USD crashed to $3,100.

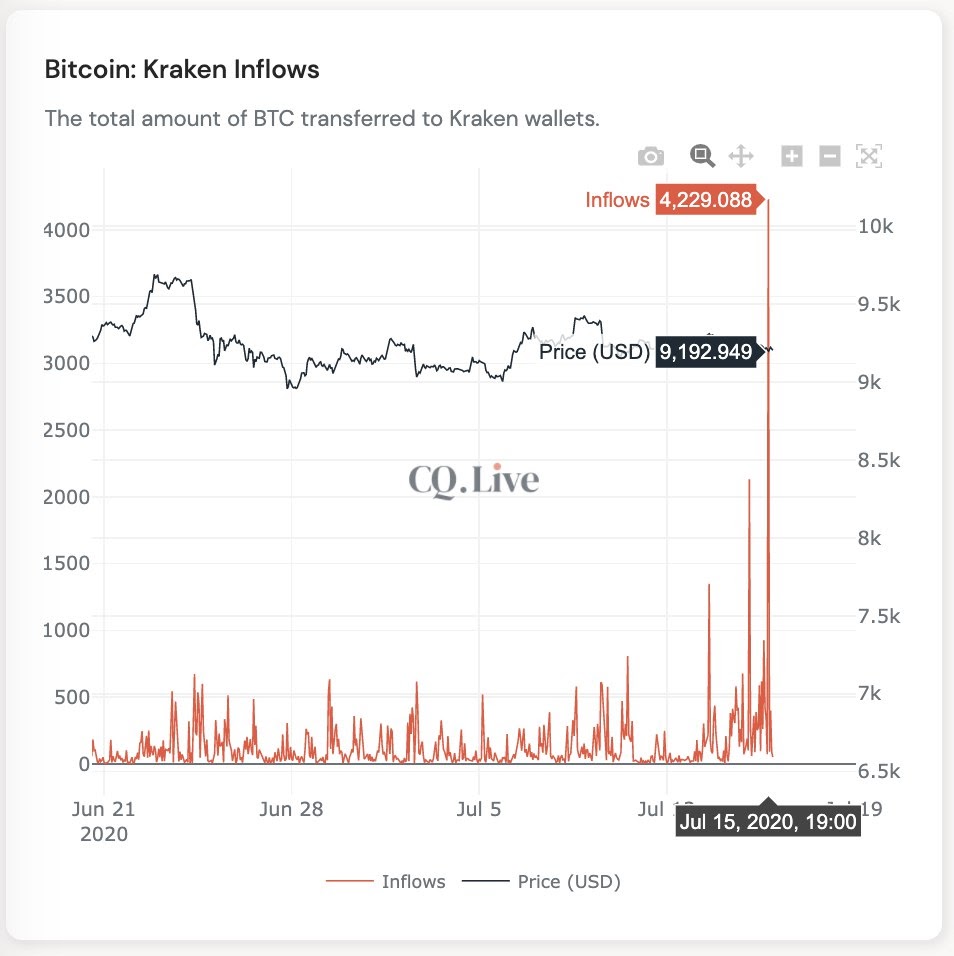

Now, according to CryptoQuant, the nervousness over weak BTC price performance is apparently sending a new signal to prepare for a new downward volatility. When eyeing the major trading platform Kraken, data shows that on Wednesday around 4,229 BTC ($38.5 million) entered the market which is far more than the average of 500 BTC (or $4.55 million) over the past few weeks.

Kraken may also be presenting one anomaly that does not reflect the trader sentiment. As they say, the overall conditions are decidedly bearish. “I expect a small pullback,” the CEO of the exchange Ki Young Ju told the crypto news media in private comments.

He apparently added that if a sell-off is initiated, he would not foresee it matching that from MArch, when a short event halved BTC/USD within hours.

buy udenafil online https://farmerslabseeds.com/wp-content/themes/pridmag/inc/dashboard/css/new/udenafil.html no prescription

“In my opinion, it’ll be around $8,800,” he said.

We can also see that while the BTC exchange inflows are rising, the number is less pessimistic than other targets. For instance, the analyst filbfilb recently highlighted the 20-week moving average of Bitcoin and how it reached an average of $8,200 as a realistic buy support zone.

Data from Skew markets also showed that the 30-day realized volatility for BTC recorded its smallest reading since 2017 this week.

#bitcoin realized volatility on a three years low, Tesla is eating bitcoin's lunch! pic.twitter.com/D32nj5QSSt

— skew (@skewdotcom) July 14, 2020

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post