The bTC Energy consumption dropped by a quarter after the recent crypto crash and if previous downturns are a sign, the energy consumption could fall even further in a week’s time so let’s read more today in our latest Bitcoin news.

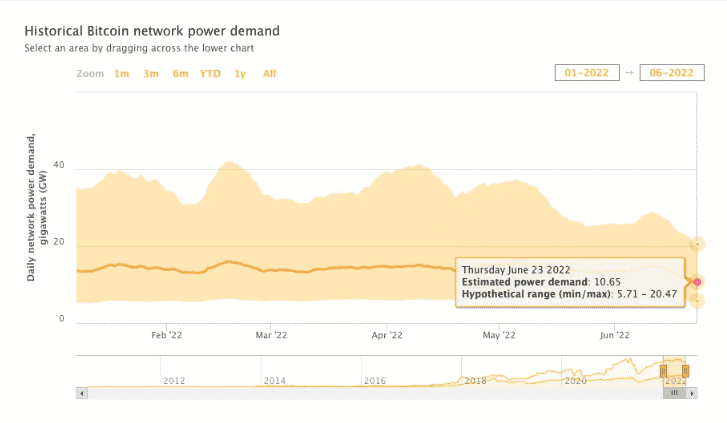

The Bitcoin network power consumption dropped to 11 GW, down 27% from the 15 GW in April as per the Cambridge BTC electricity Consumption index. The index estimates the amount of power used by BTC miners and it is maintained by the Cambridge Centre for Alternative Finance which estimates prices by determining the maximum and minimum demand for every day and produces a guess for the actual consumption. Over the same period, the BTC price dropped 53% from $44,850 to around $21,250 according to CoinMarketCap. If previous downturns are indicated, the energy consumption of the BTC network can fall further.

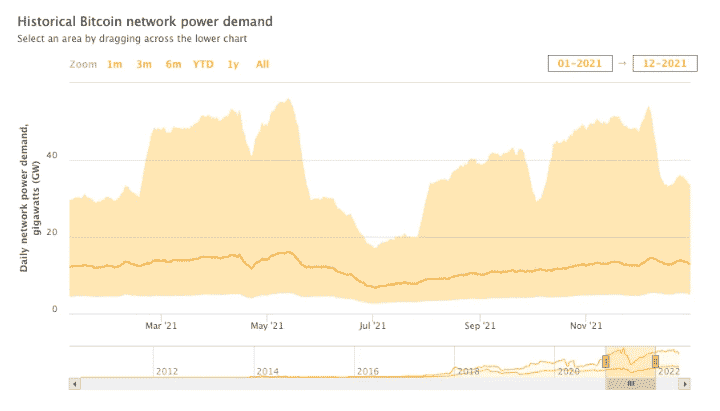

When prices crashed during the summer of 2021, they dropped 50% from what was then a new high of $63,558 down to $29,796 and the power demand for the BTC network also lagged behind but then took a few weeks to become apparent in the data. The power demand for the BTC network reached its 2021 peak in May with an estimation of 16 GW and then trailing the dropping prices by a few weeks, the estimated BTC network power demand reached a new low as it dropped 56%.

The BTC energy consumption dropped after the price slump compounded by the BTC mining crackdown in China as well whcih forced companies to shut down or to move out. There’s evidence that the miners already started preparing for a period of low profits. The publicly-traded BTC miners that need to disclose the sale of BTC in their filings, sold more BTC in May than mined and for example, the Toronto-based Bitfarms sold 3000 BTC for $62 million last week which was half of the company’s holdings.

Bitfarms CFO Jeff Lucas added:

“Since January 2021, we have been funding operations and growth through various financing measures. We believe that selling a portion of our BTC holdings and daily production as a source of liquidity is the best and least expensive method in the current market environment.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post