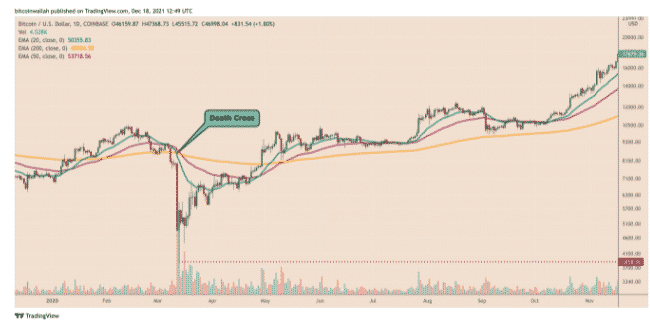

The BTC Death cross that pushed the price below $28K reappeared once again and this bearish crossover between the 20-day and 200-day exponential moving average hints at a drop to $40K so let’s take a closer look at today’s Bitcoin latest news.

The technical sell signal is about to appear on the BTC daily chart. The BTC death cross that pushed the price to $28K reappears and it is a market indicator that occurs when the short-term moving average slips below the long-term moving average. In this case, the BTC-20-day exponential moving average will close below the 200-day exponential moving average.

The indicator could end up alerting the traders and the investors about a selloff in the next few sessions given the history of the bear trends predictions. For example, the 20-200 bearish crossover that appeared in May, was a key in crashing the BTC price from $36,500 to $28,800 in the 24-hours. A similar death cross occurred in March during the pandemic-led market crash a day before the BTC price dropped from $8000 to $4000. BTC was correcting over the past four weeks and it is now poised to close the ongoing weekly session in losses as well as after the FED taking more aggressive action on inflation.

In the past 30 days, the BTC price dropped by 17.50% including the correction from the record high of $69,000. The cryptocurrency shortly fell to $42,333 but rebounded later and paired some losses as shown in the charts. The rebound didn’t turn into a bullish reversal as the BTC price was trending lower after finding the interim resistance close to the $50K level. Bitcoin’s efforts to retest the $50,000 for a bullish breakout face opposition from the descending channel’s resistance combined with the downside pressure of the 20-day EMA and 200-EMA waves that are sitting near $50,000.

As a result, the path of resistance for BTC seems to be on the downside, and with the death cross looming, the crypto will continue trending inside the descending channel and will test the levels of $42,000 for a stronger pullback. If the decline accelerates, the price could hit $40,000 as a downside target. Another leg lower will push BTC’s daily relative strength index into the oversold territory below 30 but for now, the momentum indicator was trying to break above the downward sloping trendline which in the past predicted Bitcoin’s local price bottoms.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post