A new BTC death cross is forming again but there are a few reasons why it could not be as bearish as some think so we are reading further in today’s BTC news.

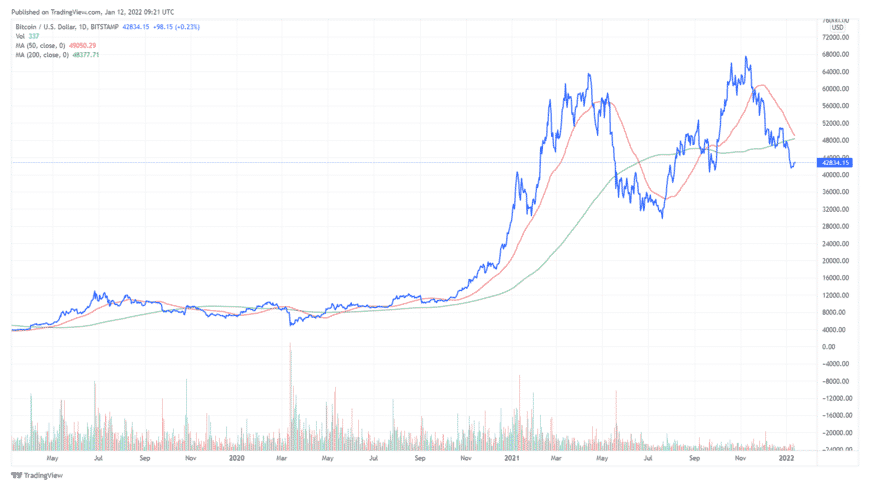

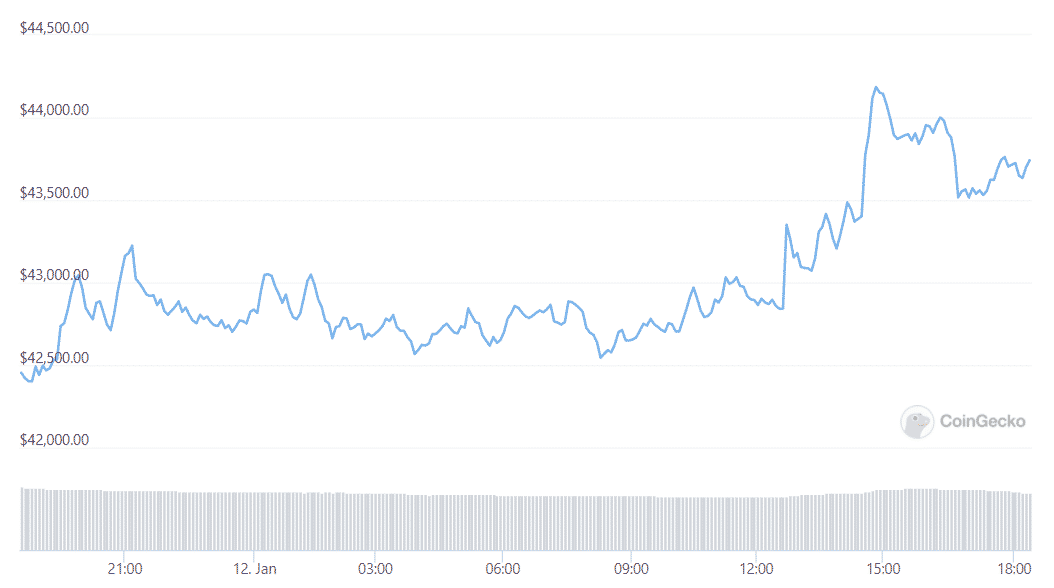

The past few months were quite turbulent for the BTC price which is a voaltile as ever. A little bit more than 60 days ago, Bitcoin’s price reached a new high below $70,000 however now it is trading 42% below that of around $43,000. The volatility shifted the moving averages a bit in the interim and two of the more important ones are the 50-day and 200-day MAs as they are on the verge of completing the pattern of the BTC Death cross.

The death cross is a technical analysis pattern that shows two long-term moving averages which are interacting in a way where the smaller one crosses below the longer one. The most common indicators used are the 50-day and the 200-day moving averages. At the time of writing, the MA50 is on the verge of crossing below the MA200 which means that the BTC death cross is forming again. The traditional analysts are telling us that the death cross is a technical pattern that shows the potential for a major sell-off and that is what most people see as well. Here are a few reasons for which it could not be as bearish as you believe.

There was a tremendous increase in Bitcoin’s volatility over the past year and with this came the formation of many patterns rather often with the death cross being no exception. The pattern was already formed on a few different occasions in 2021 alone. In any case, it is important to note that as the volatility of the asset increases, so does the formation of the patterns that are often invalidated faster than usual because of the turbulent market conditions.

The previous death cross happened back in June when Bitcoin’s price is trading near $35,000 so while the price dropped to below $30,000 by the time the death cross is formed, the bulk of the summer correction was completed and the same can be said about the occasions from the past. All patterns based on the moving average are lagging because they are based on the pre-defined period however the longer this period is, the more indicators will lag. It could be the case that most of the correction is through given that BTC is trading over 40% below its all-time high.

buy lipitor online healthcoachmichelle.com/wp-content/themes/twentytwentyone/inc/en/lipitor.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post