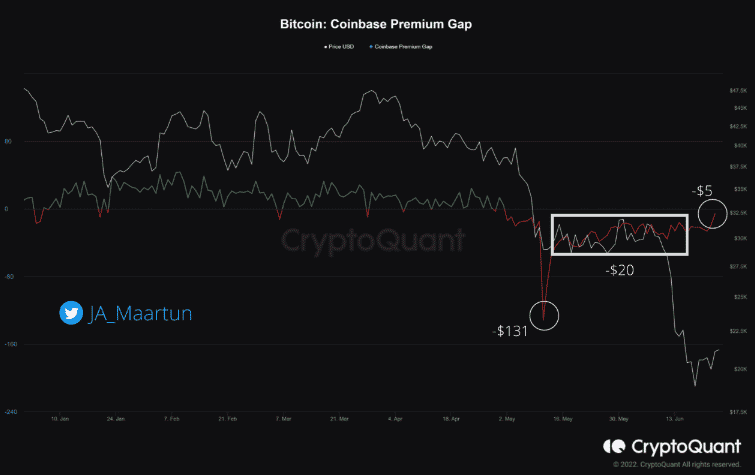

The BTC coinbase Premium gap reaches zero and the on-chain data shows that it improved recently nearing the neutral value, suggesting the selling pressure could be drying up so let’s read more today in our latest Bitcoin news.

As pointed out by analyst CryptoQuant, the selling pressure from US Investors seems to have reduced in the past few days. The BTC Coinbase Premium Gap is an indicator that measures differences in BTC prices connected on exchanges Binance and Coinbase. The quant noted that US investors are known to use the Coinbase platform for high-net institutions and entities. When the value of the metric is positive, it means that the coinbase prices are higher, and such as trend suggests there’s buying from US investors.

On the other hand, the negative premium gap implies there’s some selling on the crypto exchange and the prices are lesser than on Binance. The charts show that the BTC coinbase Premium gap has been negative in the past few months. With the LUNA Crash, it reached a red value of $131 which means there’s some strong selling from US investors. During the consolidation period that followed, the value of the indicator moved sideways near negative $20. over the past few days, the trend seems to have changed and the premium gap is observing some upwards movement. While the indicator is a negative value, it is close to zero with the gap between Coinbase and Binance standing at -$5 which shows the selling pressure from investors was dying down.

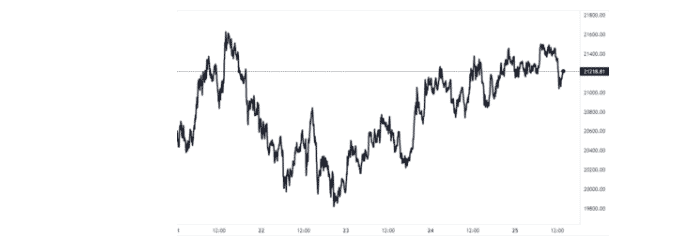

At the time of writing, Bitcoin’s price floated near $21.2K and increased 11% in the past week. Over the past month, the crypto lost 28% in value. Since the low blow at $18K, BTC was trying to recover but the crypto is now finding it hard to leave the $21K level.

As recently reported, Coinbase will launch a Coinbase derivatives exchange formerly known as FairX and will offer futures priced at 1/100th of a BTC. The retail investors will be able to trade crypto futures via Coinbase on Monday as the biggest exchange in the US by volume will offer them on the Derivatives Exchange Platform. The move came after Coinbase acquired FairX as a part of its goal of offering crypto futures and options trading to customers. FairX was selling futures products and was registered with the CFTC which gave Coinbase a running start on the $3 trillion derivatives market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post