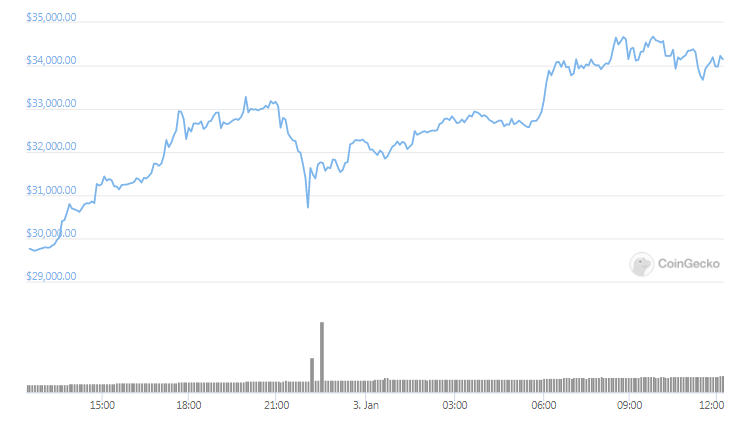

BTC blasts past $34,000 in only 24 hours after it hit the $30,000 price point as an all-time high so let’s take a closer look at the price analysis in today’s bitcoin news.

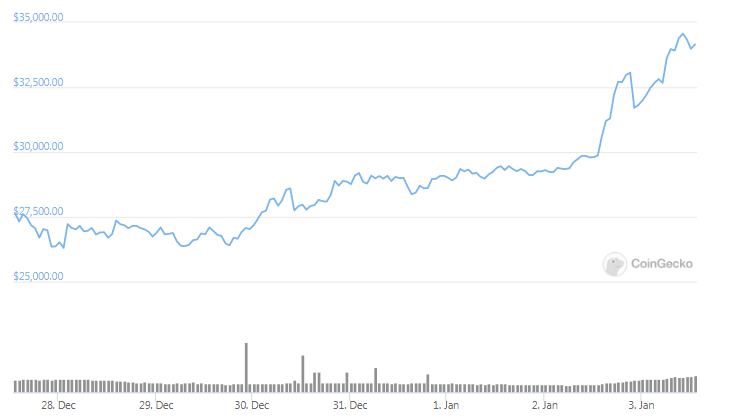

In only one day, BTC marked a $1000 increase in its price which brought the leading cryptocurrency combined gains of $5000 in 2021. BTC blasts past $34,000 for the first time on Sunday in what was an extended record-setting holiday rally and adding the immediate reaction to the 12-year anniversary of Bitcoin’s network. Once the price crossed the $30,000 mark for the first time a day ago, it seemed that the resistance vanished but it increased by $3000 in seven hours and reached a new all-time high of $33,136 before settling down to float between $30K and $33K. Jim Bianco who is a well-known macro strategist tweeted:

“Bitcoin makes TSLA [Tesla] look like it is standing still.”

The Saturday evening ended in Bitcoin resuming the climb and setting a new all-time high of $34,544 right after Day 3 of the new year. It later gave up some of its gains and is trading above $33,000 which marks a 15.09% increase in only 24 hours. This is certainly a wild start to 2021 and follows a landmark year where the cryptocurrency increased by 300%. In December 2020 BTC gained almost 50%. It breached a three-year-old high of $19,793 and then by the end of the year, it increased to about $10,000.

On the third day of 2021, the BTC price increased by about $5000 and brought its year to date return to about 12%. Boosting the bull run was the growing narrative that BTC represents a form of “Digital Gold” and brings in a flood of institutional investors into the cryptocurrency. One of them was Anthony Scaramucci’s Skybridge Capital with $182 million invested in BTC, MassMutual with $100 million in December, and Guggenheim Investments as well. Bitcoin’s price was driven by the institutional money and there’s not enough supply according to Laurent Kssis who is a managing director at 21 Shares. He said:

“The number of family offices asking to invest in our ETP is just staggering. I’ve never seen this before. In 2017 it was just retail knocking at the door now it’s only institutional.”

Kssis’s statements were supported by the fact that there’s a huge number of whale entities and clusters of crypto wallet addresses that are held by one network participant that holds at least 1000BTC and this number increased the past Wednesday.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post