BTC addresses in loss reach an all-time high amid the $18K price target that the cryptocurrency is set to hit this week so let’s have a closer look in our latest Bitcoin news.

More entities are underwater at current prices but there is almost no consensus over the conditions improving just yet. Bitcoin entered the weekly close on July 3 after a weekend of trading which produced a brief wick below $18K and the Bollinger bands signal volatility as well. The data from Tradingview shows that BTC/USD is stuck to the $19,000 level for the third day in a row. The pair went light on volatility overall at the weekend but at the time of writing it was on track for the first weekly close below the halving cycle in December 2020.

#Bitcoin Bollinger Bands tightening on the daily time frame as displayed on the width indicator: pic.twitter.com/c0bqmMfdSi

— Matthew Hyland (@MatthewHyland_) July 3, 2022

The preivous weekend action produced a late surge that saved the bulls from a close below $20,000. the momentum remained weak over the week of Wall Street Trading but the traders were unconvinced about the potential of a new relief bounce. Popular Twitter account Crypto Tony wrote:

“Looking for a push down to the lower support zone at $18,000 while we are below $19,300. Quick scalp and tight invalidation. “

Another analyst dubbed Ninja continued:

“I can’t really trust this move because it’s ‘weekend pa,’ continuing “iif bulls can’t push to $19.7k, I don’t think the dump is over.”

The incoming volatility has been eyed by commentators as the weekly close drew near. Analyst Matthew Hyland noted that the Bollinger Bands indicator was showing signs that the price conditions will become more erratic. On the daily timeframes, the BTC/USD pair traded near the bottom Bollinger band and threatened a new drop below if the volatility of a similar force occurred in May. Fresh data in the meantime shows that a little pain is left for the average holder as they are going through the worst monthly losses since 2011.

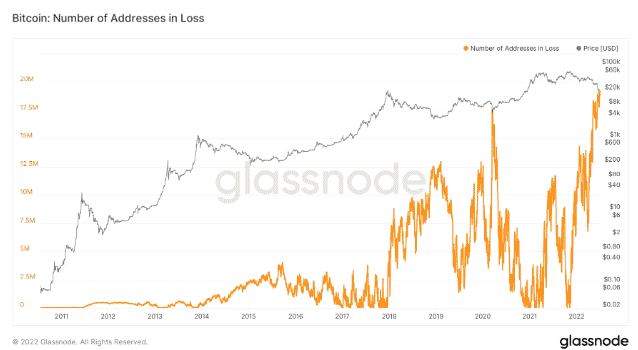

The BTC addresses in loss are hitting a new high and the data from Glassnode shows that the weekly moving average number of unique BTC addresses reached 18.8 million. In preivous capitulation events we also read the 60% of the supply needed to see some unrealized losses and $40 billion in BTC net realized losses is coming to a close:

“Some have quit, some have stuck around. One thing is for sure- if you’ve been in this space over the last year and you’re still here, you’ve been through quite a lot of volatility.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post