The booming bitcoin makes a comeback and could continue playing a global safe-haven asset as Wall Street veteran blasted off Jerome Powell and his inflation policies as we can see more in our latest Bitcoin news today.

The Wall Street veteran, Andrew Parlin explained his opinion in an editorial saying that the booming bitcoin makes a comeback as a safe-haven asset but warned about how the Federal Reserve chairman thought the inflation rates will be contained near the central bank’s 2 percent target. This is getting even more difficult as Mr.

buy kamagra oral jelly online http://petsionary.com/wp-content/themes/twentytwenty/inc/new/kamagra-oral-jelly.html no prescription

Powell vowed to keep interest rates near zero and continue purchasing the government and corporate debts at a rate of $1.4 trillion until 2024. Parlin noted:

“If this policy stance seems incongruous, that’s because it is.”

The investment advisor called out Powell’s dovish outlook as an asymmetrical monetary experiment because to him, the loose policies could cause many losses through the “entrenched inflation” which the US hasn’t seen in decades. Parlin added:

“Given how inflated asset prices are, the bust that would follow would probably be unusually severe and protracted.”

The finance veteran further stated Powell’s dismissal of inflation risks came from the lower consumer prices since the 2008 collapse and found that the fractal is irrelevant if put in after-pandemic conditions especially when one looks at the US government’s stimulus packages in the past 12 months which is five times of the amount of fiscal spending pointed at the 2008 recession:

“Common sense suggests the risk of a mighty boost to inflation, far above the Fed’s 2.4 percent projection for 2021.”

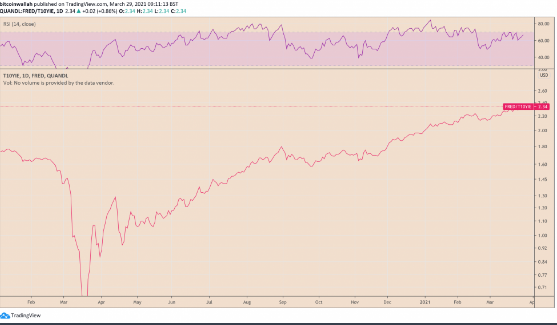

Investors chose crypto because they believe it will serve as an insurance asset against the rising consumer price indexes. This narrative was simple as BTC has a limited supply cap of 21 million tokens while the US dollar comes with an infinite supply. The scarcity is what makes BTC an alternative hedge for parking value and safe-haven features and as investor Paul Tudor Jones said it:

“In a world where you’ve got $90 trillion worth of equity market cap, and God knows how many trillions of fiat currency, etcetera…it’s the wrong market cap, for instance, relative to gold, which is $8 or $9 trillion.”

The cryptocurrency increased three times in 2021 and logged a new record above $61,000 but Bitcoin’s growth accelerated especially after Tesla, Microstrategy and Square purchased billions of BTC for their asset sheets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post