One of the most popular financial media outlets in the world Bloomberg calls Bitcoin “a resting bull” and estimates that the dominant coin is headed to $13,000 which is its main resistance point this year.

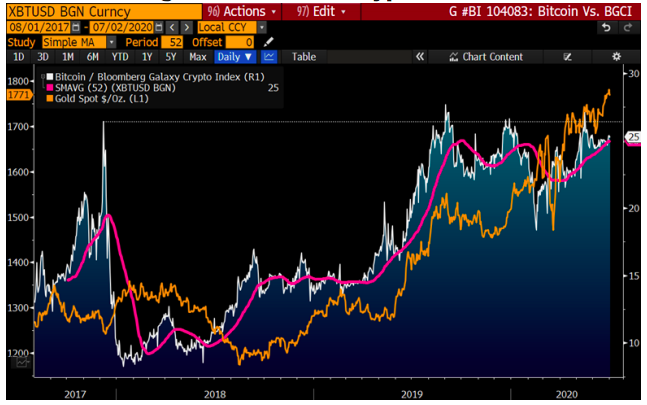

In a new report which was shared at the start of this month, Bloomberg compared Bitcoin with gold and other crypto assets. The portal said that volatility should continue declining as the cryptocurrency extends its transition to the crypto equivalent of gold from a highly speculative asset. However, the primary demand and adoption indicators remain favorable in their outlook.

That said, Bloomberg calls Bitcoin a cryptocurrency which is becoming more like gold in an increasingly favorable macroeconomic environment for the quasi-currencies. The team believes that it will continue outperforming more peers. In that manner, the real-time Bitcoin demand indicators shared by Bloomberg in the Bitcoin news are positive, which is why the Grayscale Bitcoin Trust (GBTC) has been successful and with good returns lately.

Bloomberg calls Bitcoin a solid cryptocurrency which is outdistancing the broader market. And while the report clearly states that “there is only one gold,” it also says that Bitcoin is the equivalent in the crypto asset marketplace.

Continuing, Bloomberg calls for more action as Bitcoin is maturing with a rising futures open interest. The demand for BTC, as the cryptonews show, is good just like the demand for the Grayscale Bitcoin Trust, which Bloomberg also addressed.

In the last section, Bloomberg calls Bitcoin “a resting bull” which is “caged and set for a breakout, eyeing $13,000 resistance.” The team also address the consolidation from recently and the stability near the $9,000 mark which may be one of the signs for a potential new rally in the books.

“In the process of maturing from a highly speculative crypto asset to a digital version of gold, we expect Bitcoin volatility measures to continue to decline. Its 260-day volatility, at about 4.4x that of the same gold measure, is the lowest since April 2017,” the report concludes.

A breakout is expected soon both from the analysts at Bloomberg, who said that $8,000 to $10,000 is the primary consolidation range.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post