BlockFi submitted a registration form for a new Bitcoin Trust with the US SEC Regulator and it will likely compete with Grayscale since trusts are becoming more popular in an absence of a BTC ETF so let’s read more about it in the latest Bitcoin news.

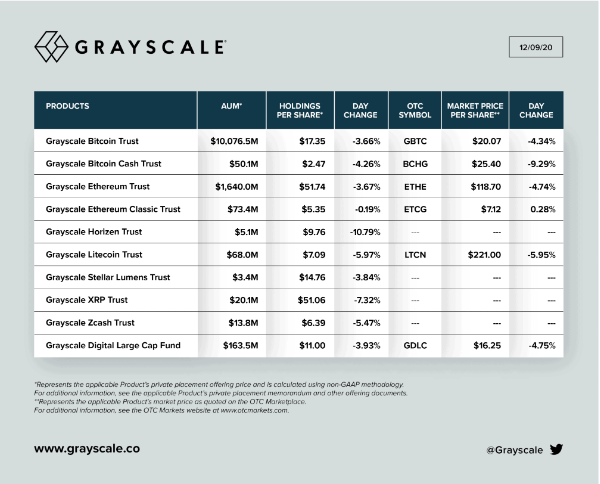

Crypto lending company BlockFi submitted a registration form for a BTC trust with the US Securities and Exchange Commission and if it gets the green light from the US SEC, it will directly compete with the Grayscale Bitcoin trust. The details in the registration form are quite scant but other examples of BTC trusts involve publicly-traded shares in a pot of the invested money that the trust uses to purchase BTC. The shares in these trusts usually trade a huge premium to the cryptos in which the trust invests and also includes a large management fee.

Bitcoin trusts like these are the one thing that is the closest to a Bitcoin Exchange Traded ETF which still looks far and will sell for cheaper shares that represent BTC purchased by the fund managers. These shares will trade on the stock market and the retail investors will be able to purchase shares in a BTC ETF and invest their pension for example in them. The SEC blocked applications for bitcoin ETFs on the grounds that the market is easily manipulated. Some companies like Valkyrie Digital Assets and VanEck refilled or submitted applications for a BTC ETF after the previous SEC Chair Jay Clayton stepped down. While the entire ETF industry waits, trusts like Grayscale are growing in strength. The Grayscale BTC trust holds $22.9 billion.

BlockFi was founded in 2017 in a “centralized” crypto lending company but unlike decentralize alternatives like Aave and Compound that rely on code guides by their communities, BlockFi is run by a company operating out of New York City which lends out crypto deposited in the vaults to the larger companies. The company is also backed by Coinbase Ventures, Winklevoss Capital, and Galaxy Digital.

On the other hand, It seems like there are new Grayscale trusts that have been registered in Delaware, for Cosmos, Polkadot, and Aave as well as the privacy coins Cardano and Monero. As with other trusts that were filed previously, the registrations were made by the Delaware Trust Company that is Grayscale’statutory trustee for the state.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post