Bitcoin’s supply tightens as the liquidity crisis continue and the rally was marked by strong accumulation by the holders. In our latest Bitcoin news, we take a closer look at the analysis.

The number of BTC exchanges has decreased strongly in the past few months despite the rally as analysts believe that this can be attributed to the institutional players that purchase BTC for the long haul. These investments are expected to boost BTC higher over time as the supply of the coins on the market drops. Analysts believe that BTC is in the middle of the supply-side crisis as BTC pushed to a fresh all-time high. Some of the rally was been driven by derivatives buyers but it was clear that there’s a huge amount of BTC being accumulated through spot exchanges.

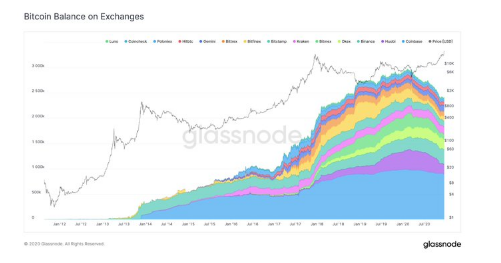

Rafael Schultze Kraft, the CTO of Glassnode, shared charts showing the price of BTC and the supply of the coin on exchanges over a macro time frame. Even since, the total highs seen during the Feb rally to $11,500, the number of BTC exchanges was in a sharp decline. Kraft and many others saw this as a sign that BTC is in the middle of the supply and liquidity crisis which will likely push the prices higher:

“#Bitcoin is in a supply and liquidity crisis. This is extremely bullish! And highly underrated. I believe we will see this significantly reflected in Bitcoin’s price in the upcoming months. Let’s take a look at the data.”

As Bitcoin’s supply tightens, the institutional players are to blame for decreasing bTC on exchanges. Earlier today, Microstrategy confirmed that it has finished buying 30,000 BTC

“TYSONS CORNER, Va.–(BUSINESS WIRE)–Dec. 21, 2020– MicroStrategy® Incorporated (Nasdaq: MSTR) (the “Company”), the largest independent publicly-traded business intelligence company, today announced that it had purchased an additional approximately 29,646 bitcoins for approximately $650.0 million in cash in accordance with its Treasury Reserve Policy, at an average price of approximately $21,925 per bitcoin, inclusive of fees and expenses.”

This adds to the 40,000 BTC that has already purchased in the past few months. MicroStrategy is one of many corporate and institutional clients that bought the leading asset. Just the other week, American life insurance company MassMutual said that it had bought $100 million worth of BTC and the company was joined by other insurance companies.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post