Bitcoin’s S&P 500 correlation hits a 5-month high and some analysts consider this to be a bearish factor for the cryptocurrency but let’s see why in our today’s Bitcoin news.

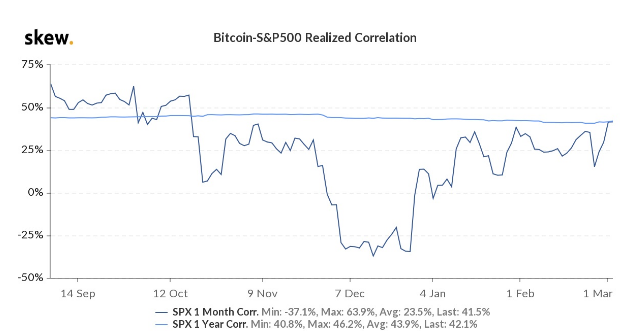

Bitcoin and the traditional financial markets were correlated highly n the past few months which was clearly seen over the past couple of weeks where the cryptocurrency followed stocks step by step. The data from crypto analytics resource skew showed that the realized correlation between Bitcoin’s S&P 500 correlation surged to a 5-month high which has happened back in November 2020. There are plenty of reasons why this could be the case but maybe the most obvious one is the involvement of institutional investors in the crypto space.

03/03/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $39.2 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC pic.twitter.com/66MdIBKKFT

— Grayscale (@Grayscale) March 3, 2021

As reported plenty of times, the institutional interest in the asset class surge when companies started flooding the market. Grayscale for example saw its assets under management skyrocket over the past few months. The company’s CEO Michael Sonnenschein said that the institutional interest in BTC increased in 2021. In any case, there are many implications of the soaring correlation. The correlation to stocks shows a few things but the most important one was the fact that BTC fails as a hedge against the traditional finance systems so if BTC Is moving along with stocks, then it doesn’t serve as a hedge.

This has implications on its own and for example, we saw one reason for the 25% correction for BTC that was actually due to Wall Street crashing as well. Back then, NASDAQ had a slump and the catalyst was that the government bond yields gave some boost and investors favored companies that benefit the broader economic recovery, as Peter Tuz who was the president of Chase Investment Counsel, said:

“Rates matter. At 1.5%, the yield is comparable to S&P 500 dividend yield. […] And there’s no capital risk with a 10-year, you’ll get your principal back. All of a sudden it’s competitive with stocks.”

As much as it is bearish, in the case of higher correlation the broader macroeconomic events need to be factored in the price formation of the cryptocurrency. The US House of Representatives passed another $1.9 trillion stimulus bill which will be another major injection in the economy if passed so we can only imagine what it will do to the stock markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post