Bitcoin’s S&P 500 correlation hits the highest levels since July 2020 according to new research as we can see more today in our latest Bitcoin news.

Bitcoin maintained a low correlation historically to traditional asset classes including commodities and equity indices. However, in the past few weeks, the leading cryptocurrency’s correlation to the two biggest indices Nasdaq and S&P500 has been on the rise. It reached the highest correlation since July 2020 at 0.61 to 0.58 according to the reports from Kaiko data provider. The correlation coefficient is usually given as a number between -1 and 1.

Bitcoin’s S&P 500 correlation is reaching the highest levels not seen since July 2020 and the closer it is to -1, the stronger the negative correlation is. The closer to 1, the stronger the positive correlation is. There could be different reasons for the high correlation but Kaiko pointed to last week’s events after minutes from the US FED meeting was released. The data shows that the central bank is also considering hiking the interest rates by mid-March:

“The Federal Reserve’s December meeting had a strong impact on global financial markets, with traders reacting swiftly to the prospect of monetary tightening.”

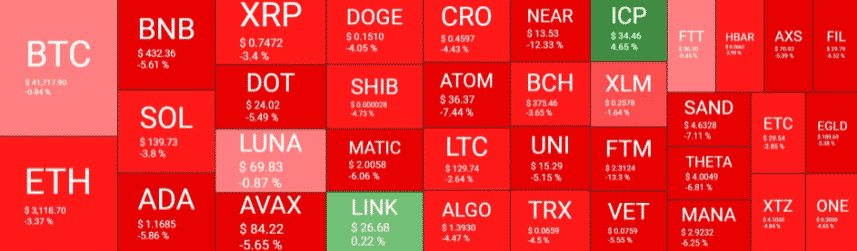

The S&P500 is down 2.63% since the start of the year while NASDAQ lost 5.62% of the value in the same time frame. At the same time, Bitcoin dipped below $40,000 on Monday and it is down by 9.79% since the start of the year according to the data from CoinGecko. As per the reports, Bitcoin behaved like a risk asset and even though its correlation with gold is a safe haven among investors, it remained negative since last year.

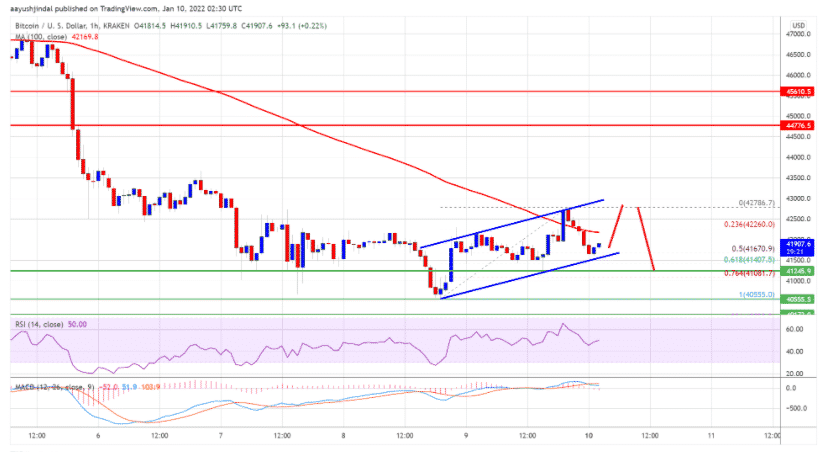

The past 24 hours were quite exciting in the crypto market which went on a rollercoaster. The entire ordeal left about $350 million worth of liquidations as BTC dipped to a multi-month low below $39,000. Now bitcoin finally rebounded to $42K. Yesterday was quite a difficult day which was characterized by a drop in the price of the leading cryptocurrency. The daily candle opened and closed at the exact same time with a 0.07% decrease. While the price opened at $41,850, it hit $42,250 and bottomed near $39,558 according to the data from Bitstamp. The latter is the lowest point since September 21st, 2021. it is worth noting that BTC spent about a few minutes below $40,000 with the bids quickly filing and catapulting the price back above the key level.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post