Bitcoin’s skyrocketing hash rate only signals that a major bull run is coming ahead, in only a few days before the halving event occurs. Bitcoin will experience its latest block reward reduction which will ensure that the number of coins issued per block will get cut in half which will result in a 50% reduction in the inflation as we are reading further in the latest Bitcoin news.

The block rewards being cut in half means that the revenue of miners will be cut in half but it seems that this hasn’t stopped Bitcoin’s skyrocketing hash rate which measures the computational power processing transactions from reaching a new high. According to the latest data shared by the blockchain analytics company glassnode, Bitcoin’s hash rate hit a new all-time high at about 150 exahashes per second.

#Bitcoin hash rate hit a new all-time high. pic.twitter.com/XtPbZRU8wp

— glassnode (@glassnode) May 3, 2020

This signals that the Bitcoin miners are allocating more capital to the network than ever before. Whether the surge of hash rate is related to the new mining machines or the latest Chinese regulations is not clear. The Bitcoin holders have experienced the effects of the increase in hash rate and the block explorers registered 16 blocks mined in only one hour which is far more than six blocks per hour which were considered an average. The hash rate is nine times higher than the hash rate in 2017 when Bitcoin reached $20,000.

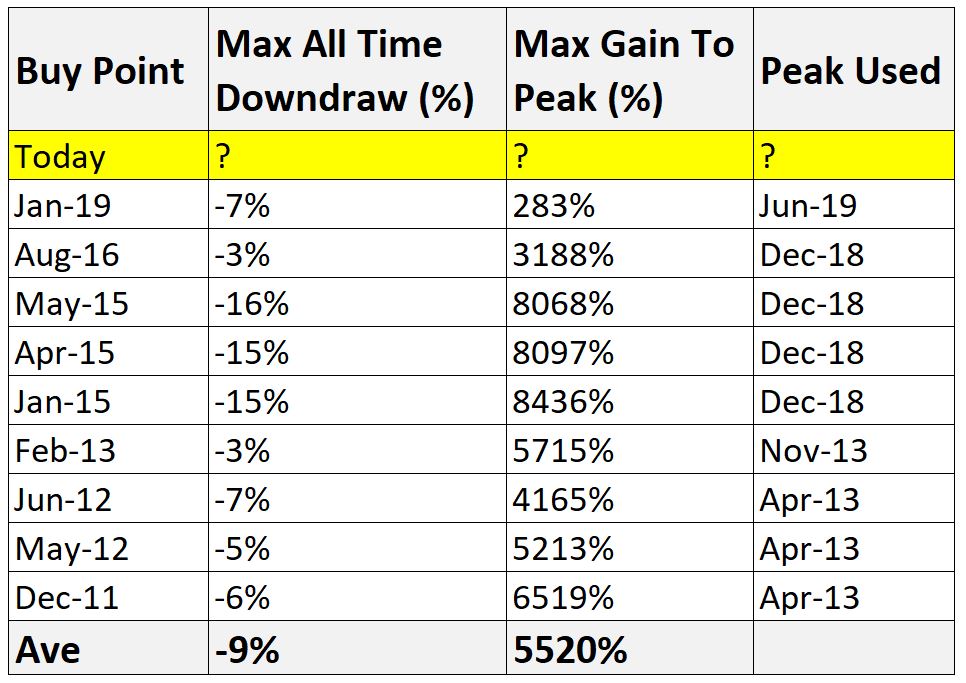

Only six weeks ago, the miners were turning off their machines because of the dramatic 50% drop in the Bitcoin price to $3,700 region. The latest surge in hash rate confirms the end of the capitulation. The digital asset manager Charles Edwards found that each time when Bitcoin ends a capitulation, a strong surge follows with an ‘’average gain-to-cycle-peak’’ of more than 5000 percent in only a few years.

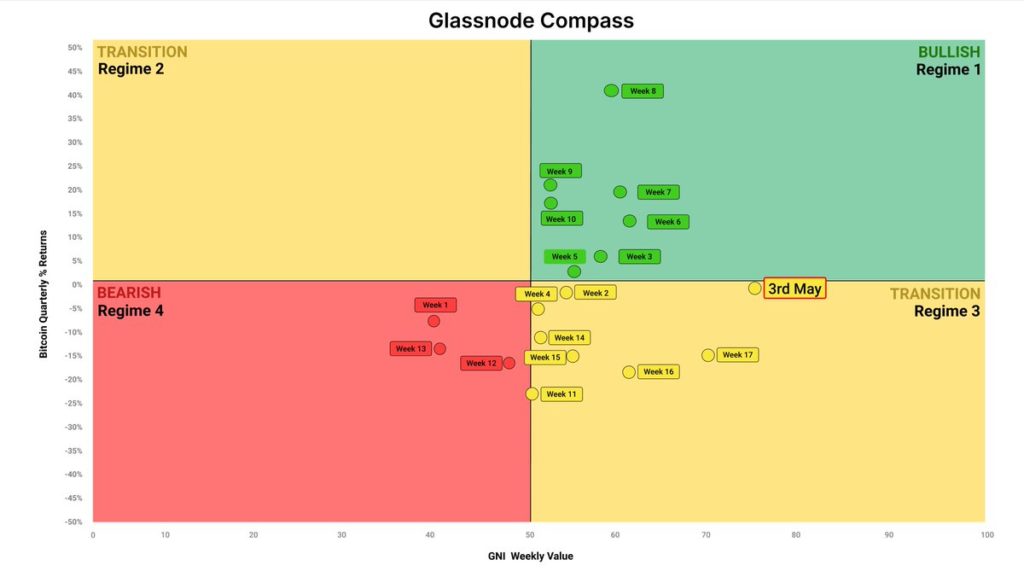

The skyrocketing hash rate is not the only metric that signals a huge move back into the bull market. According to the Bitcoin news that we have today, the charts show that the ‘’compass’’ of bitcoin’s market regimes indicating that the cryptocurrency is shifting towards a bullish market because of the increase in on-chain metrics and a growing number of users. For example, the number of active addresses on the network is reaching a monthly high with 840,000 addresses per month. The number of daily entities that use the BTC network reached 17,000 per day which is the same level from 2019.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post