Bitcoin’s price set to rebound soon as it shorted on the Bitfinex crash by 25% as we can see more in our latest Bitcoin news today.

Bitcoin bears should watch out for a potential blow as the margined short positions number on the Bitfinex crash by 25%. The dataset dropped to 11,066 BTC on Saturday compared to the 14,897 BTC at the session’s open. In the meantime, the drop came as a part of a bigger downside move which started on July 15 while on the day, the total number of margined short positions reached 17,053 BTC. The BTC/USD shorts represent the number of margined bearish positions on Bitfinex measured in BTC and the traders borrowed funds from the exchange to bet on the bearish outcome for the instrument or the pair. With that said, the latest data shows that the traders reduced their leveraged bearish exposure on the BTC market, and Bitcoin’s price set to rebound.

Popular trader Scott Melker claimed that the massive drop in short positions on bitfinex leads to a run-up in the spot BTC prices adding that he will be watching markets for a new bullish reaction. If you take a closer look at the shorts correlation there’s an erratic positive correlation. The Bitfinex short position went for a Bear Run after 2020 which is a period that coincided with a spike across the BTC spot and derivatives market. A run-down in Bitfinex short positions coincided with a BTC price surging from the lower $45K to a high of $65K.

The downside pressure on BTC sustains despite the drop in the BTC-USD shorts also as Grayscale investments unlocked 16,000 BTC worth of GBTC shares after a six-month lock-up period. JPMorgan & Chase strategist led by Nikolaos Panigirtzoglou warned that the grayscale Massive unlocking event can become the source of a new selling wave on the market. On-chain analyst Willy Woo echoed similar concerns a week ago, explaining that when GBTC premium drops it usually diverts investors from spot markets. Woo said:

“Investors now have more incentive to by GBTC shares rather than BTC, it diverts some of the buying pressure on BTC spot markets. This is bearish.”

JP Morgan is bearish on the GBTC unlock coming up.

Here I'll go through the inner workings so you can make up your own mind.

There's 2 impacts, one bullish, one bearish. The key is in how they interact. IMO it'll be immediately bullish.https://t.co/xcfMbhCBPP

— Willy Woo (@woonomic) July 6, 2021

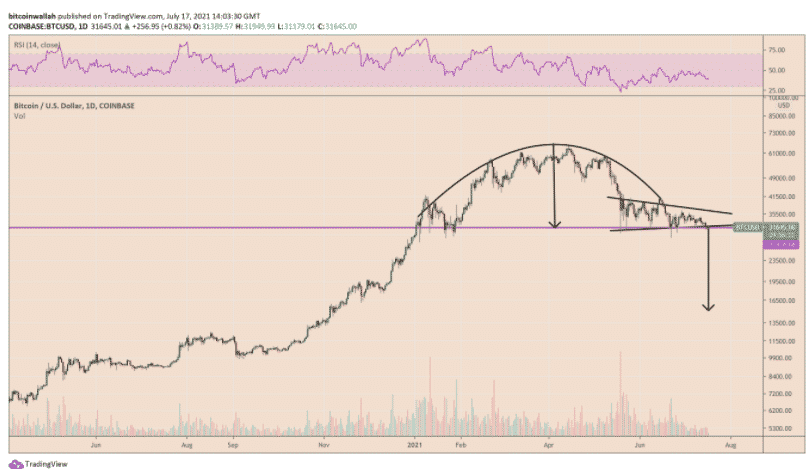

NebraskanGooner also expects a blast scenario for BTC if it drops below $30K and this formation of an inverse cup and handles formation seeing BTC crashing below $20K on the next breakdown below the $30-31K range as it can be seen on the charts. Woo predicted a bullish outcome and said:

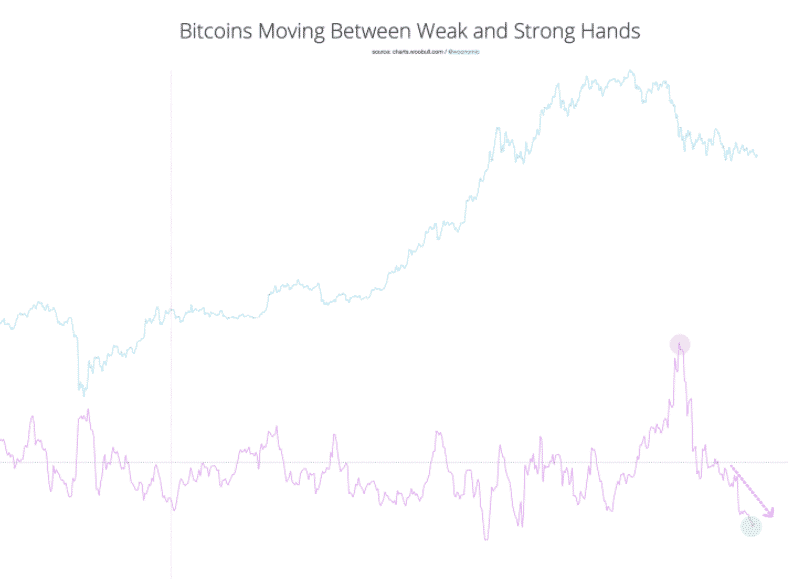

“Coins are moving away from speculators to long-term investors (strong hands) now at a rate unseen since February when price propelled from $30k to $56k. ’m expecting the price to break from its bearish sideways band in the coming week followed by a recovery to the $50k-$60k zone before some further consolidation.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post