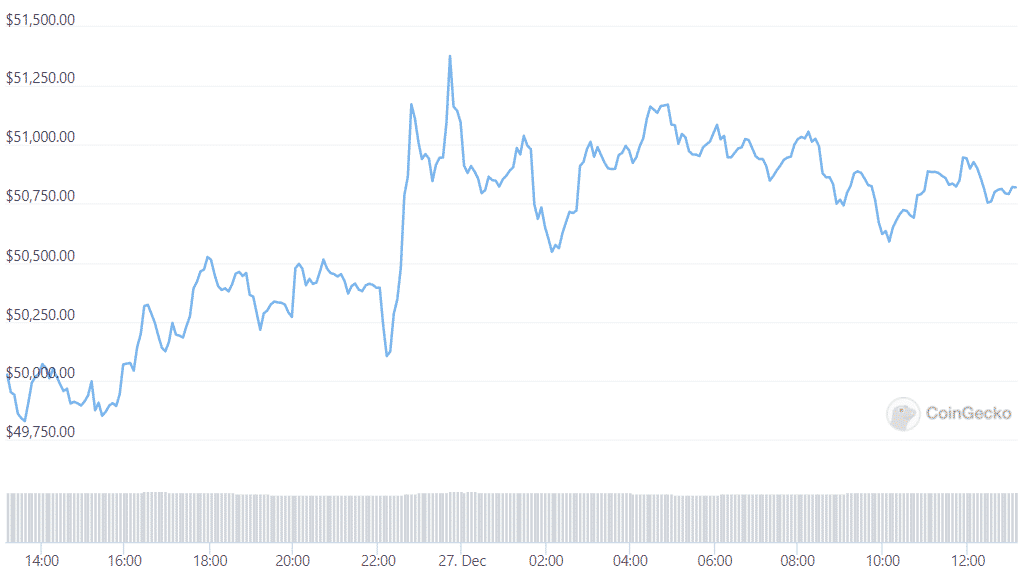

Bitcoin’s price glued itself below the $50K price level after the Xmas weekend and trading was light across all exchanges, with ethereum’s price remaining roughly flat so let’s read more in today’s Bitcoin price news.

Bitcoin’s price glued itself below this $50K level after the “Santa Rally” sent it above $51,000. At the time of publication, Bitcoin regained ground and hovered near $50,800. crypto trading activity was muted on Christmas day mostly and the day after Boxing Day in the UK. Bitcoin’s trading volume acorss exchanges still remained low. Ether and other alternative cryptocurrencies moved a little over the weekend as well but at the time of publication, Ether was changing hands at near $4070 which is down from Friday’s rally to above $4100.

Still down from its 30-day high, DOT was one of the top gainers over the weekend, and it increased over 8% in the past day. As the crypto markets moved thorugh May and April, most buyers started cashing out as fear and doubt overwhelmed the traders. The concerns included a US capital gain tax on the digital assets and Bitcoin’s environmental footprint even sparked an outright ban on mining in china.

We also saw how Tesla’s BTC acceptance and Coinbase’s direct listing helped to send the BTC price to a new high near $65,000 which turned out to be the market peak. Some investors and traders started to cash out as the concerns mounted over the US capital tax gains and Bitcoin’s environmental footprinting which imposed a ban in China. It seems that the FUD was coming all at once which stifled Bitcoin’s growth.

As recently reported, The amount of Bitcoin’s supply is drying up and has been falling since the halving in 2020 as per the study from CryptoRank with more access to acquire BTC on exchanges whcih is also declining. However, by the second half of 2020, the supply of BTC on exchanges stood for 9.5% of the quantity. The percentage declined to 7.3% of all BTC on wallet exchanges and only 6% percent of Bitcoin supply was accounted for the exchange wallets but since the halving, Bitcoin’s falling supply in circulation was on a downward trajectory with 1.3 million BTC in circulation.

However, it is worth noting that coinbase is still the most popular crypto exchange in terms of total BTC held in the wallets and lost some of the clouts over the year. According to CryptoRank, Coinbase used to account for almost half of the BTC on wallets but the number decreased to 44.2%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post