Bitcoin’s market cap soars above some of the largest financial institutions like Bank of America and JPMorgan Chase’s amid a sustained bull run which launched the number one cryptocurrency above $48,000 so let’s read more about it in our latest Bitcoin news.

The data from CoinMarketCap shows that Bitcoin’s market cap soared above $900 billion and hit a new all-time high of $48,745 surpassing the valuation of Visa which currently has a market cap of $462.9 billion, PayPal with $349.44 billion, and Mastercard that has $339.10 billion. Bitcoin’s market cap is larger than the one combined of JPMorgan Chase and Bank of America as well as Citygroup with an aggregate market cap of $851.87 billion as the data shows.

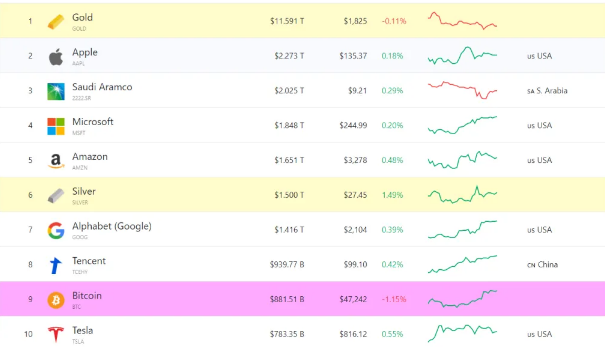

The number one cryptocurrency is ninth on the list of top assets by market cap. Gold has a market cap of $11.59 trillion right after Apple, Saudi Aramco and Microsoft, and Amazon. The primary cryptocurrency sits above Tesla, Facebook, and Alibaba but below Google’s parent company Alphabet and Shenzhen’s tech firm Tencent. Ethereum made it in the list of top 100 assets by market cap with the leading smart contract platform taking the 52nd spot surpassing Wells Fargo and Morgan Stanley.

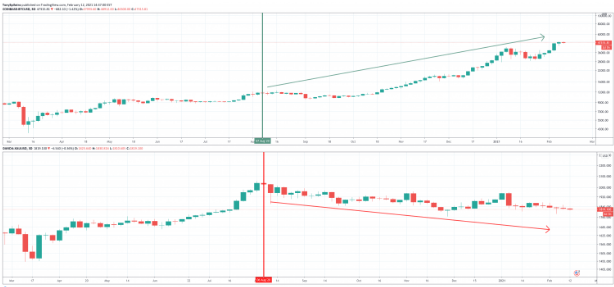

Tesla’s investment has just put Bitcoin’s market cap en route to $1TN while many found the prediction made by Plan B in his bullish paper “Modeling Bitcoin Value with Scarcity” back in 2019 for the same level, crazy. Following the latest developments, this prediction seems to be closer than ever. Plan B noted that certain precious metals like gold have maintained their monetary role because of their costliness and the limited supply rate and he applied the same argument to BTC which is now more valuable as a programmed algorithm that reduces the supply by half every four years to mint 21 million units. PlanB also plots the Stock to flow model against the US dollar market capitalization alongside two SF data points for gold and silver. The paper concluded that BTC’s price will rise because of its decreasing supply against the abundant dollar.

In the meantime, both gold and silver work as benchmarks to prove the BTC price trajectory. The paper predicts a $100K valuation or higher for the benchmark cryptocurrency which could push the market valuation to over $1 trillion in the long-run. The skeptics questioned the PlanB prediction given the global economy and its worth of $100 trillion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post