Bitcoin’s drop wasn’t caused by a huge whale as it seems with the price being down by more than 10% from the weekend’s ATH of $60K. The correction was assumed to be a huge whale that dumped more than $1 billion on Gemini, but the analysis shows that it’s something else in question so let’s read more in our latest Bitcoin news.

Bitcoin’s price broke above the resistance levels over the weekend which caused the leading cryptocurrency market cap to blast off and reach a new level of $62K. the breakout pattern seemed to coincide with the previous rise range but due to the lack of momentum, the price action halted. The initial cause of the selloff was due to the alerts triggering that more than $1 billion BTC was moved to Gemini. The crypto community started taking the profits right after and anticipated a larger selloff that was caused by a whale. Starting on Sunday evening, the selloff began and BTC sank a total of 10% from the previous hit high.

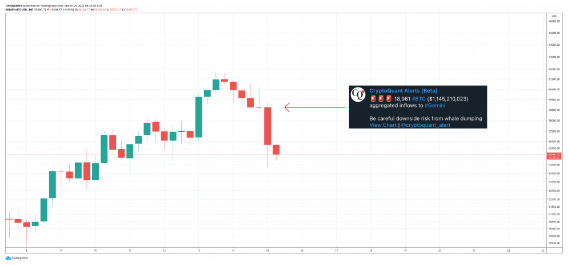

Markets selling off due to bogus data saying $1b of BTC flowing into Gemini.

It's the 2nd time it's happened in the last 30 days.

Chart: leverage positions getting liquidated as traders sell off. Red dots showing the timing of the fake inflows. (28k and 18k BTC respectively) https://t.co/bQ8WvajyEJ pic.twitter.com/FtMPW2Oy03

— Willy Woo (@woonomic) March 15, 2021

However, after everything settled down, Bitcoin’s drop wasn’t caused by a whale it seems. According to the data from Glassnode, about $1 billion in BTC was an internal transfer made on Gemini. Willy Woo said that this is the second time fake data causes a selloff on the market. most BTC investors made huge profits and understand more about crypto to know that these gains can be lost. Previous bull markets culminated with a $17K and 84% collapse in the months later, crashing the price to $20k.

An 84% crash from the prices will take the price per coin back between $11K and $24K and while this sounds extreme, the data shows that BTC did it already in the past.

As reported earlier, The BTC/USD exchange rate dropped to 4.33 percent to reach an intraday low of $53,221 and the downhill move came as a part of a broader bearish correction which started after it refreshed the all-time high of $61,778 on Saturday while the BTC/USD rate slipped by 13.87 percent from the peak level. Bitcoin’s latest drop came in contrasts with the traditional markets and in the US, the stocks saw a closing record with the S&P 500 adding 0.6% to an all-time high of 3968.94. The Nasdaq Composite surged 1 percent to 13459.71 but then failed to log a new high such as the S&P500.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post