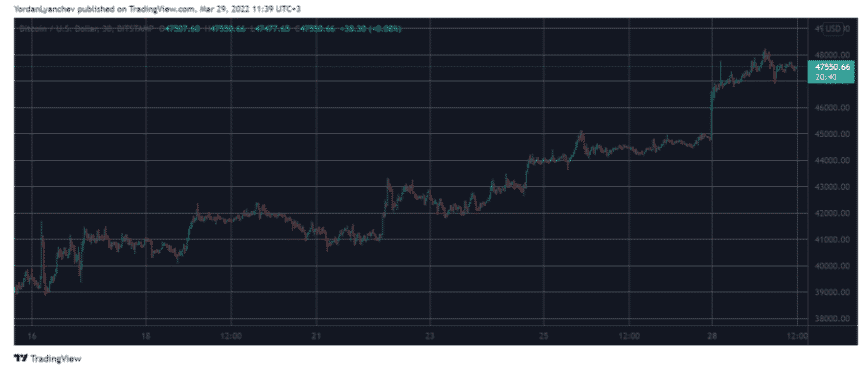

Bitcoin wiped away all of the 2022 losses and analysts point to the macro events in the market like the regulations, the stablecoin chatter, and the fading worries around COVID-19 so let’s find out more in today’s latest Bitcoin news.

Bitcoin wiped away all of the losses that it saw from the start of the year. In the first 30 days of 2020, BTC’s price dropped from $47,733 to $35,070 and then struggled to regain ground but lately, there have been a few other catalysts for upward mobility. Treasury Secretary Janet Yellen said that she has a little bit of skepticism about crypto in her interview with CNBC and added that the payment system innovation can actually be a healthy thing. She has been negative on crypto which is why this comment marks a huge change.

where is the $10bil coming from?

— Adam Back (@adam3us) March 22, 2022

There is a compounding effect of Bitcoin’s price hitting a milestone because it means that the asset is no longer in the red for 2022. the recent price activity can be a sign that the fear and uncertainty generated by the war in Ukraine and COVID-19 started to subside as per the CEO of CryptoBoost Isaac Tebbs:

“There has been a shift in the macro environment, with many investors viewing Bitcoin as oversold in the $30k-$40k range. This may be due to Russia and COVID fears subsiding.”

Tebbs said that his marketing company works with plenty of Terra-based DeFi projects and pointed to the fact that Terraform Labs CEO Do Kwon said he will purchase billions more of BTC to fund the protocol’s official wallet to back the TerraUSD stablecoin. It’s worth noting that it hasn’t happened yet but the balance held in the wallet sat at $1.3 billion after Kwon said that Terra raised $3 billion to seed the reserve and aim to raise another $10 billion.

Despite the positive price action, Pratik Gandhi who is the head of marketing at Covalent said it is too soon to celebrate and end the price turmoil regarding BTC. He will not consider the turbulence over until the price held on to the current gains for a week at least:

“Most of the recent price action has been highly influenced by the overall macro market sentiment and tracking equities. The other factors adding up to these external forces are derivatives and whales involved in high-volume trading.”

Even though BTC has often been called a safe haven asset, investors can move their money when the traditional markets crash and it followed the traditional markets since the stocks crashed at the onset of COVID. The correlation between BTC and the S&P 500 index hit a 17-month high.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post