Bitcoin will see a longer bear market with the price remaining stuck at $19K and now sign of a shift in either direction but it does show that the bottom could be coming in a few weeks so let’s read more today in our latest Bitcoin news.

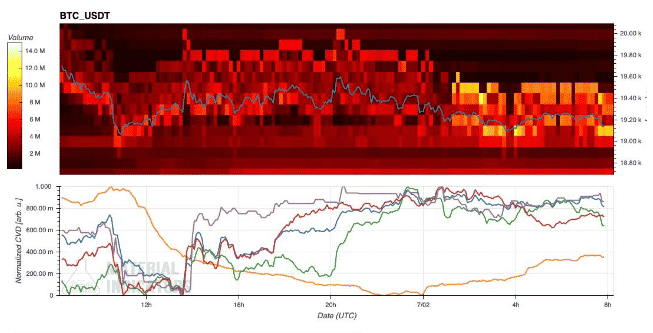

Bitcoin failed to reclaim its recent losses as traders prepared for some stagnant price action to go on. The data from TradingView tracked a limp BTC/USD as chopped around the $19,000 mark in the weekend. The Wall Street trading week finished without surprises with the US equities remaining stagnant and providing little impetus for the volatility. The US dollar index or DXY ran out of steam at about 105 points. The order book data from the biggest global exchange Binance showed BTC/USD caught between buying and sell liquditiy closing to spot price and ensuring a lack of volatility until the traders are able to maneuver and add bids or asks. The outlook seemed hardly optimistic for the bulls.

#BTC may still very well be in the “Downtrend Acceleration” phase of its correction

But this phase will precede the “Multi-Month Consolidation” phase

Which will precede the “New Macro Uptrend” phase$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) July 1, 2022

For the popular trading account Altcoin Sherpa, the conditions promised an extended period of performance from BTC which can last most of 2022:

“Its gonna take months to chop around and accumulate once the bottom is found. And the bottom might not even come for another few months from today. Hunker down for a long bear market IMO.

buy orlistat generic orlistat without prescription online

”

The sentiment was echoed by analyst Rekt Capital who argued that BTC hadn’t yet made new lows or started to consolidate:

“Deleverage yourself. Get your Bitcoin into cold storage. Sit tight.”

The next week or two prove to be the cycle lows while it does lend a degree of hope to the ones concerns that the bottom is far away. The economist Alex Krueger noted that the volume denominated in BTC reached a new high last month:

“As a general rule, trading volume is the highest when markets capitulate.”

As a general rule, trading volume is the highest when markets capitulate, and such capitulation creates major bottoms.

This weekly chart includes the aggregated bitcoin volume for most BTC pairs (spot & perpetuals across exchanges).

Volume hit its all time high two weeks ago. pic.twitter.com/6ONLibQiL2

— Alex Krüger (@krugermacro) July 2, 2022

In the 2018 bear market, the volume ATH occurred a few weeks before the price bottom and if this trend follows back around, it could be the site of the next. Rekt Capital argued that the buy-side volume was not strong enough to sustain fresh price upside in the long term, outlining the 2018 volume.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post