Bitcoin trimmed the recent gains but key breakdown support is nearby as we can see in our latest Bitcoin news today.

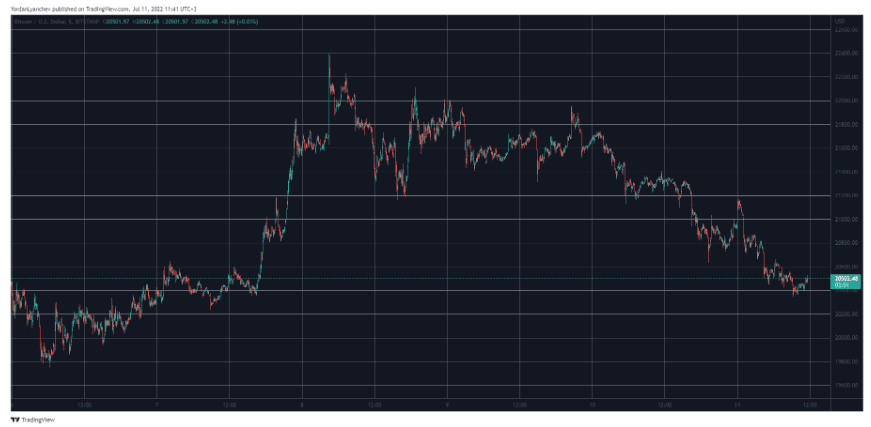

Bitcoin trimmed the recent gains and dropped below $21,000 so now it has to stay above $20,500 to avoid a huge drop in the near term. BTC failed to stay above this support and extended its drop.

buy flagyl online www.mobleymd.com/wp-content/languages/new/flagyl.html no prescription

The price is trading below $21,500 and the 100 hourly simple moving average but there’s also a major bullish trend line forming near the $20520 support zone on the hourly chart. The pair can start another decline if there’s a move below $20,500.

The BTC price tried a close above the $22,000 level but the bears remained active and as a result, there was a steady decline below $21,500. the price dropped below the 50% fib retracement level of the move from the $19,300 swing low to the $22,498 high so the price is trading below the $21,500 level and the 100 hourly simple moving average. It will be testing the key $20,500 support zone and there’s also a major bullish trend line forming with the support at $20,520 on the hourly charts. The trend line is close to 61.8% fib retracement level from $19,300 to $22,498.

If BTC stays above this trend line it can correct above $20,800 and on the upside, the price will be facing resistance near the $20,800 and the $20,850 levels. The next key resistance is close to the $21,250 zone and the 100 hourly simple moving average so closing above this resistance could set the tone for revising the $22,000 level. More gains could open the doors for an increase to the $22,500 level and the next major resistance will be set at the $23,200 level.

If BTC fails to stay above the trend line support, it can continue moving down below $20,500 and the immediate support on the downside is $20,050. the next major support sits near $19,600 and a close below this zone could push the price to $19,000. in this case, there’s a risk of moving to $18,500 and the hourly MACD is gaining pace in the bearish zone.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post