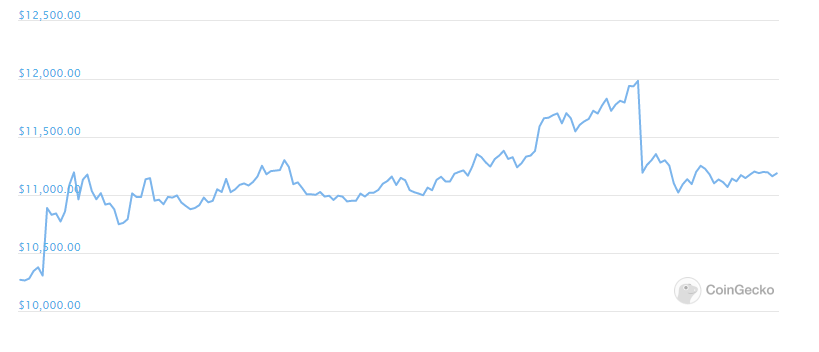

Bitcoin touched $12,000 just a day ago but crashed by $1000 in a matter of minutes. However, the market sentiment remains unphased so let’s find out more in our Bitcoin latest news.

Bitcoin touched $12,000 which is the highest value this year but immediately suffered a rejection soon after. The trading volume and the market sentiment for the cryptocurrency picked up quite a bit in the previous weeks alongside the bullish price action. Today’s drop came shortly after a flurry initiated at $99,964 wick on the quarterly BTC futures contract on Binance as the trader sentiment remains unshaken.

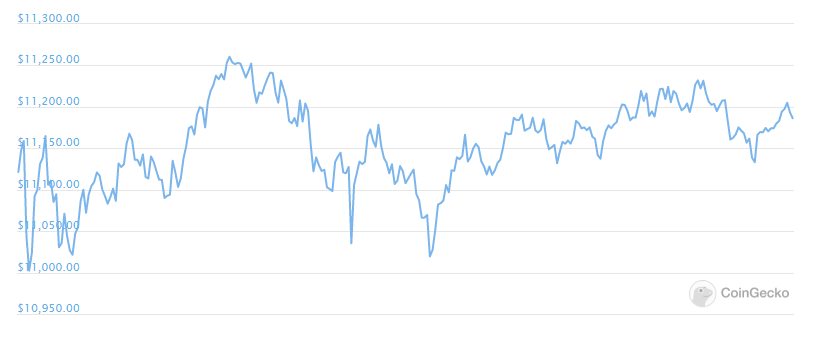

Bitcoin touched the 2020 high of $12,071 in the early morning hours before suffering a huge rejection. After climbing from the low of $11,2303 in a day, Bitcoin was quick to retrace and tumbled back to below $11,000 after losing more than $1,000 in less than an hour. The cryptocurrency recovered and is now trading sideways between the $11,000 and the $11,000 price range with a short-term trend. Bitcoin is now down more than 5 percent in the past 24 hours which is the first loss recorded in less than two weeks. Despite the sudden loss, BTC had quite the performance in the second half of July and it is still up by 11% in the past week.

The BTC trading volume has been climbing since the start of July and has doubled in the previous month. Around $30 billion BTC now changes hands every day and to put this into perspective, the current BTC trading volume is more than double that was seen during the 2017 bull run a time when BTC reached a new all-time high of $20,000. The sudden sell-off doesn’t seem to have appeared in the bullish sentiment in the market. According to the BTCtools shorts vs longs distribution chart, most of the open interest of BTC is long where just 17% is short.

Alternative.me’s crypto fear and Green index is now at the highest value in more than a year at 80 indicating a state of extreme greed on the market. It is unclear what caused the $1000 sell-off which could have been triggered by the wave of automated liquidations. According to the recent Binance notice, one single user placed a huge number of orders in the quarterly futures contract which created a sudden wick to $100,000.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post