Bitcoin surpassed Visa and Mastercard in value both combined and the biggest cryptocurrency also surpassed the world’s three biggest banks by market cap as the data shows so let’s read more in our latest BTC news today.

BTC hit $60,000 over the weekend and became worth more than the world’s three biggest banks combined. As per the data, Bitcoin surpassed Visa and Mastercard in value, with a market cap of $1.15 trillion. The combined market cap of Bank of America, The Industrial and Commercial Bank of China, and JPMorgan Chase are $1.08 trillion. Visa and Mastercard on the other hand have a combined market cap of $871 billion which is dramatically less than BTC.

Since then, BTC/USD saw a pullback and its market cap declined to $1.03 trillion while still holding the strong trillion-dollar title. The level was tipped by other analysts and consolidation zones which is still the case after the recent dip which took BTC to its lows after the ATH set in February. Others noted that the movement is impressive as BTC Went from zero to $1 trillion in network value which is 3.6 times faster than Microsoft did.

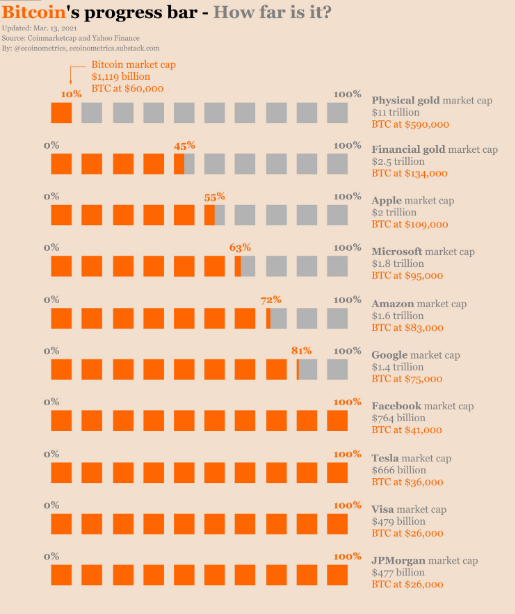

Analyzing the market cap data, the on-chain analytics company Econometrics added that Bitcoin equaled 45% of gold held in investment vehicles and 10% of the physical gold market as a whole. To eclipse the gold, which is already a debate among market participants, the pair has to trade at $590,000.

In the meantime, Dow Jones surged 0.5% to 32953.46 to post a 14th record close of the year. BTC formed a new positive correlation with the Wall Street indexes and the cryptocurrency was among the remaining assets that posted a new growth against the lower debt yielding environment. The yields started recovering sharply and investors decided to move into the safety of the US dollar that caused BTC and other altcoins to flip lower. The yield on the US-10 Treasury note dropped by 0.02 percent on Monday but remained near the 13-month peak of above 1.64% with the US dollar rebounding against a basket of top foreign currencies closing on a 0.16% higher, giving some light on the BTC market.

The two-day meeting of the FED panel will attract some more scrutiny from the BTC traders after the sharp reversal on the Treasury market so while the rates remain low, their rise is bringing more concerns over the FED dovish policies.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post