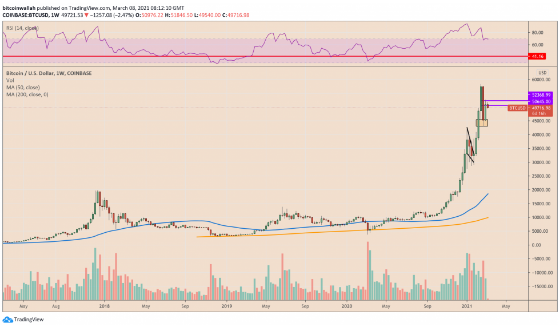

Bitcoin stops following price trends in the Nasdaq Composite which was helped by the improving signs of institutional interest in the crypto sector and the BTC/USD exchange rate surged 3.

buy cenforce online nouvita.co.uk/wp-content/themes/twentynineteen/fonts/en/cenforce.html no prescription

96 percent to $54,489 in a two-week high so let’s read more in our latest bitcoin news today.

The reports from Goldman Sachs revealed that 40 percent of the clients are exposed to cryptocurrencies and about 70 percent of them believe the cost to purchase on BTC will hit $100,000 this year. The reports surfaced a week after announcing that it will relaunch its cryptocurrency trading desk and the banking giant closed the platform in 2018 with a response to the huge downside moves that saw the prices crashing from $20,000 to $3000 in a year.

Between March 2020 and February 2021, the number one cryptocurrency skyrocketed above $58,000 from $3,858 when the traders purchased it as insurance against the global central banks’ quantitative easing programs with some thinking that the BTC limited supply cap of 21 million tokens makes it a more attractive choice than holding cash. Nasdaq companies Microstrategy and Tesla piled into BTC by using the same narrative and cited the US dollar’s yearlong drop in 2020 against the rising public debt of $21 trillion which prompted service giants like Mastercard, PayPal, BNY, and Goldman Sachs to announced BTC-enabled products like trading portals and custodians.

Bitcoin stops following the price trends from the Nasdaq Composite and reached $58,367 which is the highest level on record but lost about 26% of the valuation of unsupportive macro narratives with the huge spike in long-dated yields reducing the appeal for assets that did well while the pandemic lasts. This prompts BTC and to develop in a positive correlation.

With the yields stabilizing in one-year highs, BTC attempted recovery with the cryptocurrency forming a new low of $43,016 and the exchange rate later recovering by more than 25 percent to $54,489. Nasdaq dropped by 2.4% in a technical correction. The upside move over the week came in the wake of the many new institutional integrations with billionaire Kjell Inge Rokke’s firm Aker ASA launched a new branch that is dedicated to BTC, purchasing about $1150 BTC for the treasury reserves. Meitu, the Chinese selfie app also added BTC and ETH to its balance sheets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post