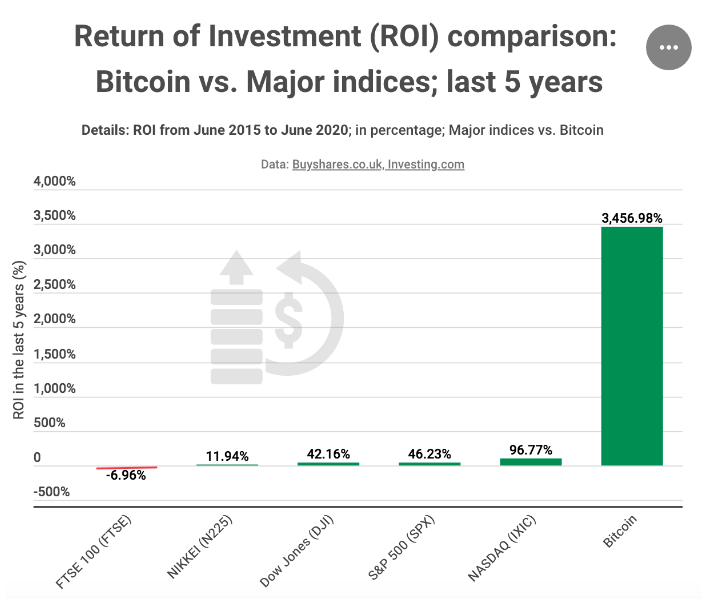

A new metric just emerged in the crypto news today, showing that the Bitcoin ROI since 2015 outperforms five major indices and puts the digital asset ahead of the traditional markets.

For those of you who don’t know, the dominant coin Bitcoin (BTC) had a nearly 3,500% return on investment since 2015 which is 70 times the one of five traditional stock markets. According to an article published on June 29 at the investor website Buy Shares, the data analyst Justinas Baltrusaitis claimed that from June 26 (2015) until June 26 (2020), the return of investment (ROI) for Bitcoin was more than 70 times higher when compared to some big indices.

The Bitcoin ROI was bigger than the Financial Times Stock Exchange 100, NASDAQ, Nikkei, S&P 500, and Dow Jones markets, the analyst said.

“During the period under review, Bitcoin’s ROI stood at 3,456.98% where in June 2015, the price of Bitcoin was $257.06 and by June 26th this year, the price rose to $9,143.58. On the other hand, the average ROI for the highlighted indices was 49.27%.”

In the Bitcoin news, we can see that the asset’s ROI measures the amount of return on an investment that is relative to its cost. In other words, the Bitcoin ROI can be best seen from the image below.

The Bitcoin HODLers ROI is calculated by comparing the price of the asset at the moment they purchase crypto up to its current value. For those who chose to HODL before the December 2017 surge, all of the investments should have a massive ROI.

Baltrusaitis also said that the Bitcoin ROI and the difference may be due to the improved regulations for the coin over the past five years. However, the current pandemic also shifted a lot of things which is why many started “viewing Bitcoin as an alternative store of wealth,” as he noted.

“Over the years, Bitcoin has been growing in popularity, and the maiden cryptocurrency status has largely contributed to the high return of investment. Bitcoin’s returns are significant despite the perennial fact investing in cryptocurrencies involves substantial risk of loss. The valuation of cryptocurrencies largely fluctuates, and, as a result, investors may lose more than their original investment.”

Some analysts even suggested that Bitcoin is somewhat still strongly correlated with traditional markets and indices like the S&P500.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post