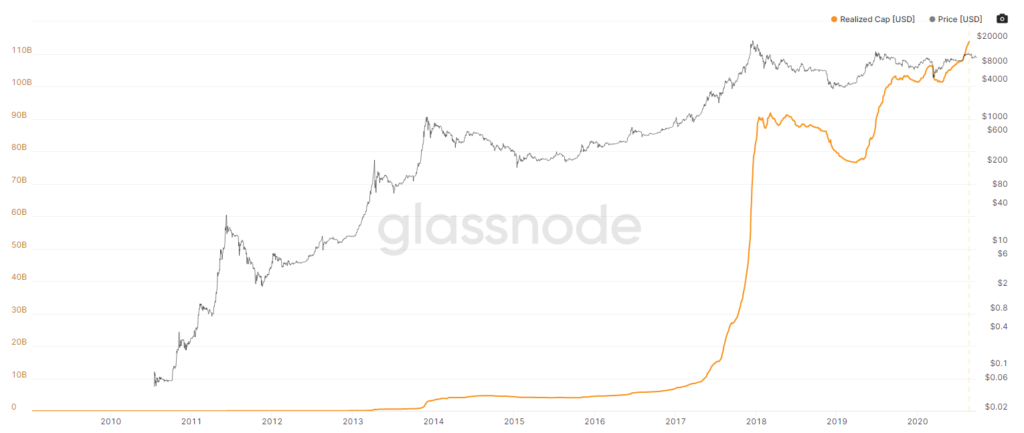

The Bitcoin realized cap, which is a metric that estimates the realized capitalization of the coin, has increased by more than 50% since tagging the all-time high of $20,000 at the end of 2017. Three years after the high, the BTC cap has soared above its record high, but Ethereum’s has struggled to reclaim its former highs.

Data from Glassnode confirms this, showing that the Bitcoin realized cap measures the value of each BTC when it last moved on-chain, enabling analysts to predict the aggregate cost-basis of the market participants.

#Bitcoin Realized Cap at ATH.

Since $BTC hit $20k in 2017, Realized Cap has grown by $43B to currently $115B – an increase of 60%.

Realized Cap values each coin at the time they last moved, and serves as an estimate for investors' aggregate cost basis.https://t.co/VPF1NecxWd pic.twitter.com/rA0sYXHl4k

— glassnode (@glassnode) September 23, 2020

However, the coins on centralized exchanges are still absent from the metric, which indicates that the data is probably more accurate in terms of the cost-basis of long-term investors, rather than the intra-day speculators.

As the Bitcoin news now show, the Bitcoin realized cap currently sits at $115 billion, which is $43 billion more than at the all-time high in 2017. The current $190 billion market cap suggests that the BTC hodlers are presently enjoying an aggregate profit of 65%.

What we can also see in a different chart by Coinmetrics is the fact that realized capitalization continued to grow higher in the early months of 2018, and is pushing to test $90 billion three times between January and May, despite the prices having crashed back below $10,000.

While there was some pre-halving speculation that saw the Bitcoin realized cap growing by 6% in the Q2 of 2020, the violent ‘Black Thursday’ crash quickly reversed the 2020 gains. Since May, the realized capitalization has steadily trended upwards.

According to the crypto data researchers from IntoTheBlock, more than 72% of the crypto addresses are currently profitable. The largest sum of investments having been made in the $1,040 to $5,285, and $8,450 to $9,560 price ranges, as the data shows.

Unlike BTC, the Ethereum news show that the ETH realized cap of $26.3 billion is still a long way from reclaiming its past highs. Currently, it sits 25% lower than the 2018 record of $35 billion. What we can also see is that Ether’s realized cap experienced a much longer downtrend than BTC, having posted a local low of $22.4 billion during mid-April 2020. According to one magazine, 62% of the Ether addresses are currently in profit, and the largest share of them were purchased for less than $160.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post