Bitcoin reaches $35K level for the first time since January after the coin started sliding amid the hawkish comments from the US FED which brought down traditional markets so let’s read more today in our latest Bitcoin news.

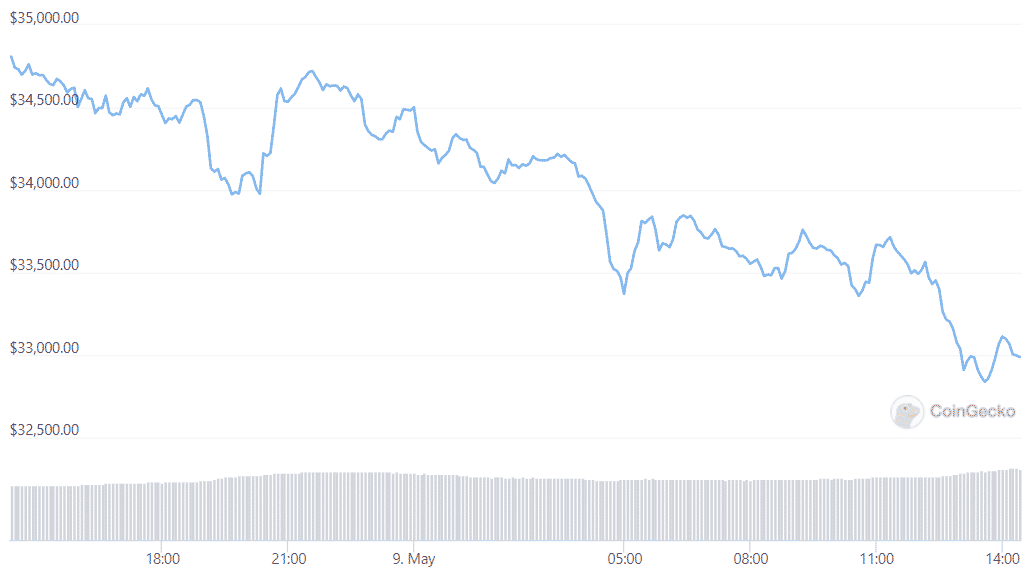

Bitcoin fell below $35,000 this morning after declining almost 4% over the past day and about 9% in the past week with the market cap of the biggest crypto crashing to $658 billion and in March, the figure stood at $900 billion. The downward pressure started after the FED announced it will raise the itnerest rates and erased the brief recovery BTC enjoyed earlier last week. The investors started pulling assets out of the BTC exchange-traded funds more than a week ago and Bitcoin reaches the $35K level outflowing the week before last totaling $133 million and the highest since June 2021.

As of the time of writing, Ethereum as the second biggest crypto by market cap was down about 5% over the past day and almost 8% over the past week and traded at $2,549. Other notable coins were lagging and APE was down 8% over the past day to $11.69 while LUNA fell more than 15% over the past day to $61.68. Avax also dropped by 7% to $52.38 on the day.

In a recent interview with the Economic Times, the billionaire investor and founder of Bridgewater Associates, Ray Dalio noted the potential of digital assets especially BTC outlined the impressive performance over the past decade. Bitcoin isn’t a good competitor to gold said the 72-year-old American investor noted that BTC’s finite supply is similar to other universally accepted inflation hedges just like gold. However, he doesn’t see the central banks adopting BTC as a reserve asset because of issues of privacy and the ban of the asset in some countries.

Also as recently reported, Following the comments from the FED, crypto, and stocks, especially Bitcoin dropped due to the FEd-fueled fears after mounting a recovery to nearly $40,000 and then dropping by 5%. the biggest cfrypto by market cap is trading hands at around $37,000. ETH as the second biggest crypto by market cap is not doing so much better. ETH crashed from over $2900 to $2750 in a few hours and amounted to a 5% drop. The overall marekt cap for the crypto assets dropped about 7% falling from $1.89 trillion to $1.77 trillion and the biggest losers include the bAYC Apecoin, the native asset powering the Near protocol, and the walk-to-earn token STPEN among others. The market volatility came amid the hawkish actions of the US FED.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post