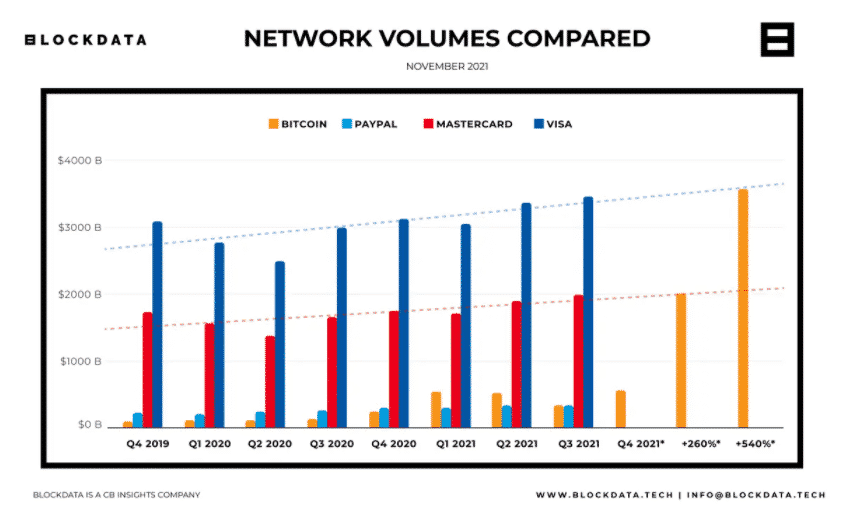

According to a new report by market intelligence platform Blockdata, Bitcoin processed more USD Value than Paypal did and it could soon surpass the one of Mastercard as it already processed 27% of the value so let’s read more in our latest Bitcoin news today.

Market intelligence platform Blockdata suggested in a new report that Bitcoin processed more USD value than PayPal and could soon surpass Mastercard in the number of dollar transactions value processed. Recently, Bitcoin overtook teh tech company PayPal in terms of value transfer and at the time of writing, the Bitcoin network recorded about $480 billion in processed value while PayPal’s value was around $302 billion per quarter.

While this represents a huge milestone for the crypto industry, the value pales dramatically against that of Mastercard and Visa with the other leading payment companies in the world. According to the data, the two credit card giants processed around $1.8 trillion and $3.2 trillion worth of transactions in the past quarter respectively. If Bitcoin’s network value is compared against these two, it will represent about 27% and 15% of the transaction volume processed by the giant fintech companies.

buy lipitor online nouvita.co.uk/wp-content/themes/twentynineteen/fonts/en/lipitor.html no prescription

Blockdata showed in their report that Bitcoin’s network process volumes could reach the ones of Visa and Mastercard, suggesting that it will match the companies in the dollar amount of transactions being processed:

“If Bitcoin were to increase its value transferred per transaction today by 260%, it would be processing an equivalent volume to Mastercard on a daily basis.”

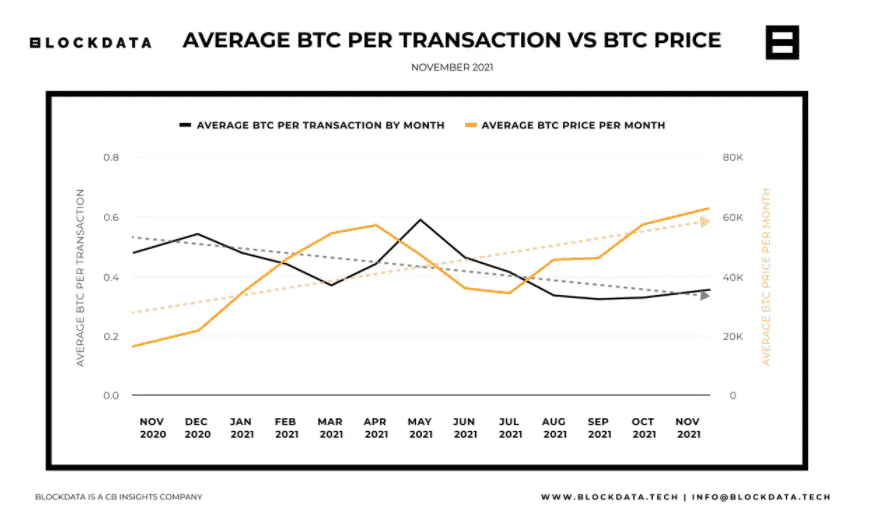

The report identified a rise in the price of Bitcoin as another main factor that could send the value process of the BTC network to the same level as Mastercard. If Bitcoin continues with its pace, it will match Mastercard’s level in a few years so if the current pace of growth is sustained, Bitcoin could process the same level of transactions with the payment companies by 2026. however, if Bitcoin’s average price is taken into consideration, it could take to 2060 before the network matches the one of Mastercard. The report also concluded that even if BTC is unable to match the growth of the payment companies, it performed well for a network that started about a decade ago.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post