The halving which occurred this Monday in the Bitcoin news is starting to show some results. Today, we can see that the Bitcoin price scores $9,000 after the BTC halving, while the miner revenues have fallen by 47% in one day. The price volatility has also dropped, meaning that more investors are flocking to the markets.

Right now, Bitcoin (BTC) is priced above $9,000 as new data reveals just how much money miners are losing after the third halving. According to data from the popular aggregators, the Bitcoin price scores new levels as it rose to the $9,000 mark and is prepared to match the performance it did last month.

Support above the $8,000 range has yet to appear following the halving, preceded by a flash drop in the Bitcoin price which momentarily hit the 200-day moving average around $8,200. What we can notice and see from one of the analysts covering the BTC price named Michael van de Poppe is the following:

So far, this one is going fine.

Volatility draining down on $BTC, which suits altcoins as some are showing strength.

I like that. pic.twitter.com/PxI28DXoYP

— Crypto Michaël (@CryptoMichNL) May 13, 2020

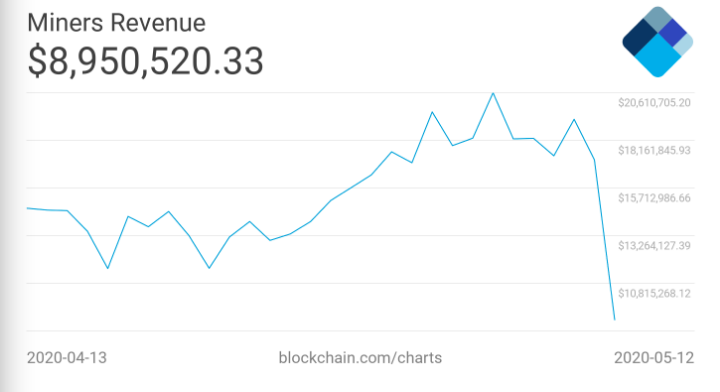

Meanwhile, the impact of this event on miners became clearer as the data confirmed that on May 12, revenue dropped by around 47%. From $17.16 million of block subsidies and transaction fees from yesterday, the total volume was $8.95 million which is derived from figures summed up by the monitoring source Blockchain.

Another analyst was quick to comment now that the Bitcoin price scores $9,000. Mario Gibney who is a customer support lead at Blockstream took it to Twitter and wrote:

“The first mining reward of #bitcoin’s 4th epoch is 7.16 BTC (6.25 block subsidy + 0.91 in fees). That means 12.7% is made up of transaction fees. An indication of the brave new world of fee-based security we’re venturing toward?”

The consensus suggests that as we move on to the next phase for BTC, the Bitcoin fees will have to rise in order to accommodate increased demand – and the premium of verifiable secure financial transactions.

At present, fees as a percentage of payouts to miners are far from the levels we saw last year when BTC hit a yearly high at $13,800. However, the overall number of transactions is now lower and this can point us to the fact that there is still room for growth in this aspect.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post