The Bitcoin price and stock correlation reached a new all-time high, which could mean a lot for the BTC price. As of lately, the Bitcoin price has been showing record levels of correlation with traditional markets – in fact, on July 9 the correlation between BTC and S&P 500 reached a new all time high.

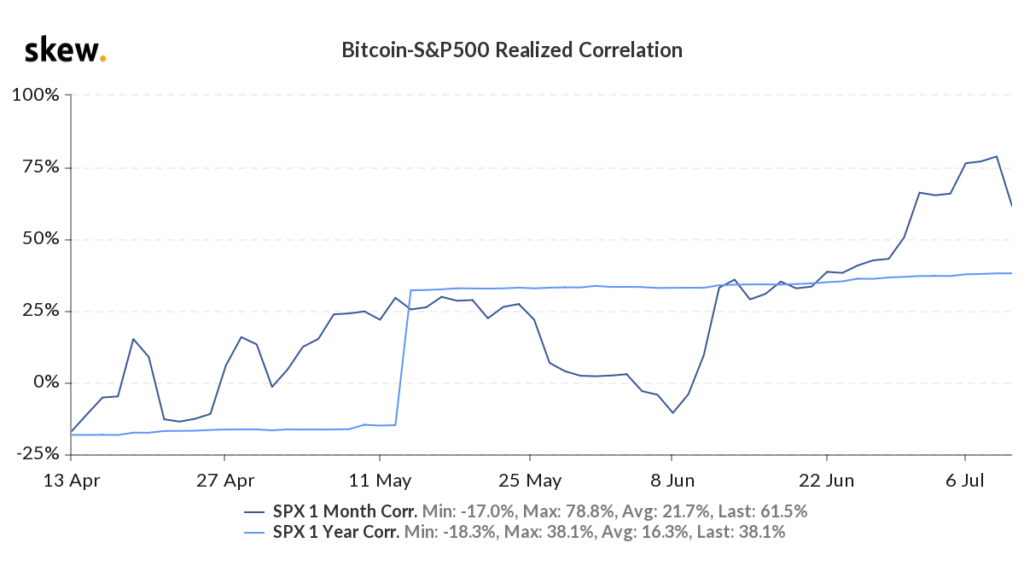

As we can see thanks to data from Skew shared in the Bitcoin news, the one-year realized correlation reached 0.38 on Thursday, July 9, and this came after the metric had reached new highs earlier this week. The correlation with traditional markets has been growing at a steady pace recently, and the one-year reaching consecutive new all-time highs.

The data from Skew visualizes the Bitcoin price and stock correlation and shows that the 1 month figure also reached its all-time high of 0.78 on Wednesday but has since dropped to 61.5.

While Bitcoin has been showing increasing correlation with the stock market, the same can’t be said for gold. The precious metal surpassed $1,800 to set a new high which was not seen since 2011.

Moreover, a recent report by Kraken’s research department found that the correlation with the precious metal has been declining. Bitcoin’s 30-day rolling correlation also hit a four-month low of -0.49, a level far below its one-year average of 0.24.

The correlation between Bitcoin and the traditional stock market grew after the coronavirus outbreak and the March 12 crash to $3,750. A new research report suggested that this trend could end after the halving but the exact opposite has happened. This is mainly due to the continued economic consequences that COVID-19 has brought.

While a new strengthening correlation between Bitcoin and the traditional stock market is now signalling something in the crypto news, some see it as a sign that the asset class is maturing. The nature of unregulated Bitcoin derivative products makes it prone to long and short squeezes.

Some analysts even suggest that the correlation may signal that Bitcoin is becoming increasingly represented across a wider range of traditionally structured portfolios, which would be a sign that adoption continues to occur.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post