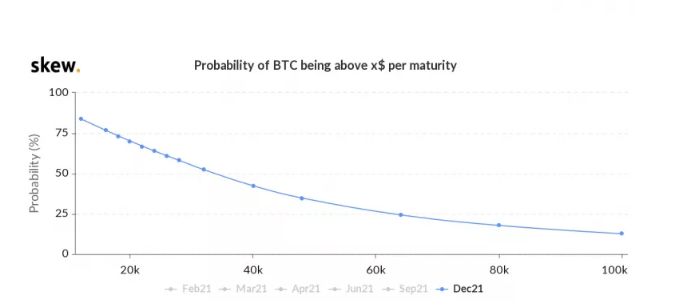

The Bitcoin options market has low chances of reaching higher highs in 2021 with a 12% probability of the prices hitting $100,000 by the end of 2021 so let’s read more in today’s BTC news.

The Bitcoin options market has a low probability of prices hitting higher than $100,000 this year despite the widespread expectations for a huge rally in the wake of Tesla’s recent purchase of the cryptocurrency. At press time, the options market is pricing 12% odds for the cryptocurrency trading in seven figures before the end of December as per the data source Skew with the probability of a break above the $70,000 is around 21%. Sui Chung the CEO of CF Benchmarks said:

“With the extreme volatility of the past two months, the market isn’t showing a lot of conviction on how bitcoin will trade for the rest of the year.”

Option probabilities are calculated using the Black-Scholes formula based on the critical metrics like the call options’ price, price of the underlying asset, risk-free interest rates, strike prices, and the time to maturation. Options are derivative contracts that give the purchaser the right but not the obligation to purchase an asset at a predetermined price before a specific date which a call option represents a right to buy and put an option that gives the right to sell. One could argue that the options market is underpricing the prospects of a stronger rally given the latest purchase by Tesla which bolstered the bullish expectations. Trader Alex Kruger commented on the $1.5 billion investment that Tesla made earlier this week:

“Prices can fly very high. I expect other heavyweights to follow suit.”

If history can be referred to, the cryptocurrency looks primed for another move higher this year having undergone the reward halving or 50% in the daily issuance in 2020. In the past, BTC scored huge gains in the year following the halving and the cryptocurrency even underwent its first and second halving in 2016 when the prices rallied by 5000% and the $1300% in 2013 and 2017. The options market seems not to be concerned with the history repeating itself as the market focus turned to other bigger-cal coins as Chung noted:

“Positioning is very bullish in the ETHUSD futures on Ether futures, which saw more than $30 million traded on day one.”

Option probabilities are not perfect indicators and they don’t quite represent the traders’ expectations which can oftentimes be wrong. The probability of the prices rising higher than $20K stood below 10% back in 2020 but the cryptocurrency ended up rallying to $40K.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post