The latest Bitcoin news show that with the upcoming halving in May 2020, the price of BTC will shoot higher. At only 15 days away from the halving, many are also exploring the Bitcoin options benefits and how trading BTC can help you make profits in these times. Despite the great potential that Bitcoin has recently, no one knows for sure how exactly its price will respond during and after the third halving.

One of the greatest choices are the BTC options – and the Bitcoin options benefits that you can easily take advantage of. As you probably know if you are reading our news, the market has matured to the extent that traders can now deploy strategies and generate gains on both sides of Bitcoin’s price action. The derivatives markets are a relatively new addition to the market, and over the past two years they developed enough to allow investors to apply even more complex investment techniques.

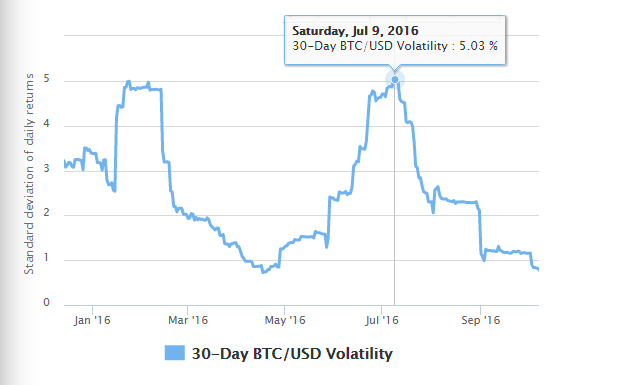

Historically, we can see that the volatility increases as the May 2020 Bitcoin halving nears. News show that the volatility measures the strength of the day-to-day BTC price fluctuations and this calculation usually entails periods of 30, 60 and 365 days for a better analysis. The current volatility of Bitcoin is shown in the graph below.

As we can all see, the crypto news now indicate that the Bitcoin options benefits are something to look at. Typically, the volatility of Bitcoin increases when the cryptocurrency nears its halving (an event occurring every 4 years). In the chart above, it is easy to see that the peak 30-day volatility coincides with the 2016 halving on July 9.

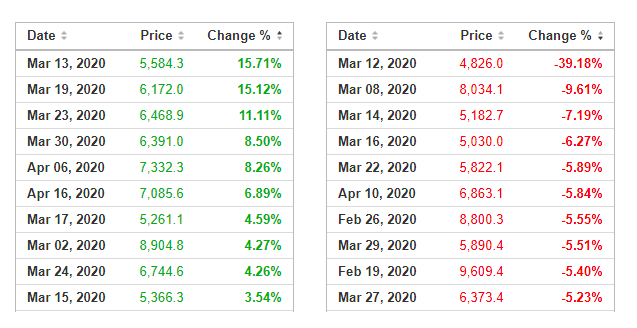

So, the Bitcoin options benefits practically show that you can hedge your portfolio exposure and profit from the volatility of Bitcoin. While the Black Thursday price crash caused a spike in the volatility, we can see that the price fluctuations were at the highest level in six years.

Recently, the volatility of almost every strong cryptocurrency has reached its highest levels since 2008. Many believe that this will continue with a Bitcoin price run in 2020 – allowing investors to reap the benefits and buy call and put options. This way, traders can easily control their BTC and benefit from its increasing price in the future.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post