The Bitcoin mining difficulty stays flat despite the 300% price gains and the bulls were mounting for a fightback after the weekend slide. The leading cryptocurrency is up by 3% and it still tries to function well after the last week’s sell-off so let’s read more in today’s Bitcoin news.

Despite the recent turbulence, Bitcoin’s macro performance was nothing less than remarkable since the end of the third quarter of the year. While the lead up to this event saw many months in across the $10K with the end of October 2020 was when things started to take off. Over the period, BTC posted about 300% gains before hitting $42K which was special about the move’s strength and speed which forced the crypto skeptics to consider this position. Marcus Swanepoel who is the Chief Executive of crypto exchange Luno said:

“Even the most bullish of bitcoin advocates could not have foreseen such a meteoric rise in price in such a short space of time.”

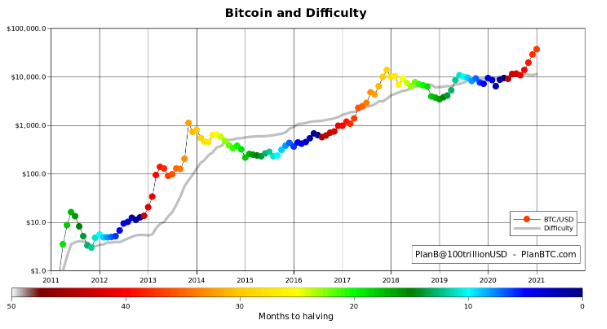

Since the rejection of the $42K, a slight normal trend returned with what seems to be an opportunity for the assessment to impact the run-up in correlation to other metrics. Twitter analyst $100trillion USD noted that the Bitcoin mining difficulty stays flat despite the strong gains over the period. In the past, the mining difficulty increased with the BTC price increasing. The most notable example of the relationship shown in the charts back in 2013 and at that time, the mining difficulty saw a steep rise as BTC went from $10 to $1000.

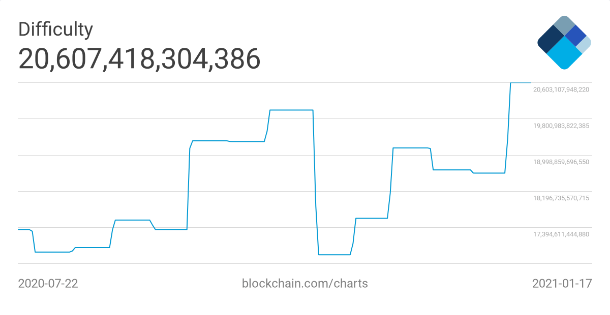

The BTC mining difficulty is a measure of how hard it is to mine one block and the higher the difficulty, the more computing power will be needed to mine the same number of blocks. The difficulty is adjusted every 2016 blocks which comes every two weeks. A more detailed analysis shows that the mining difficulty in October 2020 was set at 19.32 but it dropped to 16.79 in November as it re-adjusted upwards at the end of the year to 18.6t.

Over the course of January 2021, the difficulty became harder and led to difficulty of 20.61t. at the same time, a swing of 3 is a stagnant level of difficulty adjustment especially considering the $32k swing in the price over the same period. this suggests that the new miners are not joining the network despite the growth in popularity so we could see an increase in difficulty that will reflect the increased competition as well. Bitmain’s website showed that its AntMiner S19 Pro and T19 are all sold out until August of this year.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post