The Bitcoin mining difficulty set to adjust this week and with it, the price of BTC reclaimed the $30,000 price point which can help it get away from the bearish investor sentiment so let’s read more today in our latest Bitcoin news today.

Bitcoin is the world’s biggest cryptocurrency by market cap and retook the $30,000 level after a wave of volatility over the weekend. The leading crypto trades near $30,408 or up by 1.7% over the past day. Despite the minor recovery, BTC is still 55% down from its ATH of $68,789 from last year as per the data from CoinGecko. The investor interest in the asset surged as well with bitcoin’s global trading volume up by 20% to $24.36 billion in the past day. Beyond the price action, the technical aspects of the BTC network painted a slightly more bearish picture.

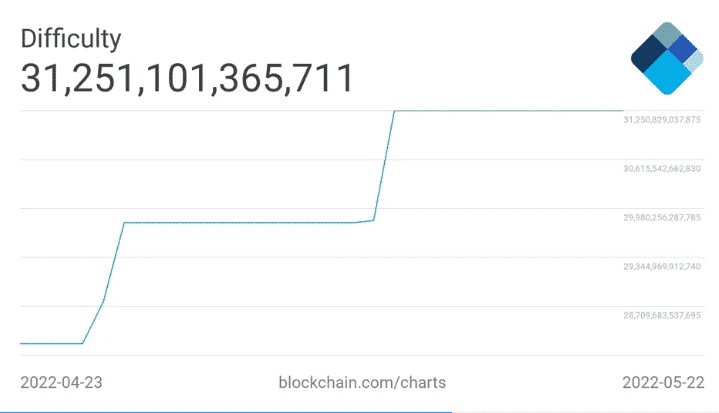

Bitcoin’s network difficulty hit an ATH of 31,252t as per the data from Blockchain.com. The Network difficulty measures how hard it is to mine a BTC block with a higher difficulty demanding more power and the metric got updated which is either increasing or decreasing every two weeks. The increased mining difficulty means that the cost of BTC increases dramatically and the current cost of production per BTC stands near $26.252 according to the mining platform MacroMicro.

The Bitcoin mining difficulty is set to adjust this week despite the potential for making a profit at today’s prices but it will seem that most miners turned off their machines. This is because the network difficulty is expected to drop by 4.1% at its next auto adjustment on Wednesday. This means that the cost of production will drop as it is easier to mine BTC so assuming the price of BTC doesn’t fall with it, it could become profitable enough and entice new machines to return to hte network.

As per the data from IntoTheBlock, many on-chain singles and general sentiment indicated the market remained bearish. The fears of growing inflation and the recent interest rate surge from the FED led to a worldwide crash across the stock and the crypto markets. Despite being recommended as a hedge against inflation, BTC emerged as being correlated with the stocks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post